Embarking on the journey of “how to coding payment gateway integration” opens a fascinating realm where technology converges with commerce. This guide delves into the intricacies of seamlessly incorporating payment gateways, transforming the way businesses handle financial transactions online. From understanding the fundamental concepts to mastering advanced integration techniques, we’ll explore the evolution of payment gateways, the benefits they offer, and the challenges that come with them.

Get ready to uncover the secrets behind secure and efficient payment processing.

We will navigate the landscape of payment gateway providers, comparing their features, pricing, and integration methods. Furthermore, we will address critical aspects such as choosing the right gateway, ensuring security and compliance (including PCI DSS), and designing a user-friendly experience. This comprehensive guide will equip you with the knowledge and tools necessary to successfully integrate payment gateways, regardless of your experience level.

Introduction to Payment Gateway Integration

Payment gateway integration is a critical process for businesses that want to accept online payments. It involves connecting a business’s website or application to a payment gateway, which acts as an intermediary between the business and the customer’s bank. This integration enables secure and seamless transactions, allowing businesses to process payments from various sources like credit cards, debit cards, and digital wallets.

Fundamental Concept of Payment Gateway Integration

The core concept revolves around establishing a secure and efficient channel for financial transactions. This channel ensures that sensitive payment information, such as credit card details, is transmitted securely and processed correctly.The process typically involves these key steps:

- Customer Initiates Payment: The customer selects items and proceeds to checkout on the business’s website or application.

- Payment Information Input: The customer enters their payment details (credit card number, expiry date, CVV, etc.).

- Data Transmission: The payment information is securely transmitted from the customer’s device to the payment gateway. This often involves encryption to protect the data during transit.

- Transaction Processing: The payment gateway verifies the customer’s information, checks for sufficient funds, and obtains authorization from the customer’s bank (the issuing bank).

- Funds Transfer: Upon authorization, the payment gateway facilitates the transfer of funds from the customer’s bank to the business’s merchant account.

- Confirmation and Notification: The payment gateway sends confirmation of the transaction to both the business and the customer.

Brief History of Payment Gateways and Their Evolution

The evolution of payment gateways has mirrored the growth of e-commerce and digital transactions. Early online payment systems were rudimentary and often involved manual processing.The history of payment gateways can be roughly divided into phases:

- Early Days (Pre-2000s): E-commerce was in its infancy. Payment processing was complex, often relying on direct connections with banks or using simple, less secure methods. Security concerns were paramount.

- Emergence of Dedicated Gateways (2000s): Companies like PayPal and Authorize.Net emerged, providing centralized payment processing solutions. These gateways simplified the integration process and offered enhanced security features.

- Mobile Payments and Innovation (2010s): The rise of smartphones and mobile commerce spurred innovation. Payment gateways adapted to support mobile payments, digital wallets (like Apple Pay and Google Pay), and new payment methods.

- Modern Era (Present): Payment gateways are increasingly sophisticated, offering features like fraud detection, multi-currency support, recurring billing, and integration with various e-commerce platforms. Artificial intelligence and machine learning are being used to improve security and streamline the payment process.

Advantages of Integrating a Payment Gateway for Businesses

Integrating a payment gateway offers numerous benefits that can significantly improve a business’s financial operations and customer experience.Key advantages include:

- Increased Sales: By offering online payment options, businesses can reach a wider customer base and cater to the growing demand for online shopping.

- Improved Customer Experience: Secure and seamless payment processing enhances the customer experience, leading to increased customer satisfaction and loyalty.

- Enhanced Security: Payment gateways employ robust security measures, such as encryption and fraud detection tools, to protect sensitive financial data and prevent fraudulent transactions.

- Reduced Manual Effort: Payment gateways automate the payment processing workflow, reducing the need for manual data entry and reconciliation.

- Simplified PCI Compliance: Reputable payment gateways handle much of the complexity of PCI DSS (Payment Card Industry Data Security Standard) compliance, reducing the burden on businesses.

- Fraud Prevention: Payment gateways incorporate advanced fraud detection systems to identify and prevent fraudulent transactions. For example, some gateways use machine learning algorithms to analyze transaction patterns and flag suspicious activity.

- Data Analytics: Payment gateways often provide data analytics and reporting tools that offer insights into sales trends, customer behavior, and other key metrics.

Common Challenges Faced During Payment Gateway Integration

While payment gateway integration offers significant benefits, businesses often encounter various challenges during the process.Common challenges include:

- Technical Complexity: Integrating a payment gateway requires technical expertise and can be time-consuming. It involves understanding APIs, security protocols, and various payment gateway-specific requirements.

- Security Concerns: Ensuring the security of payment data is a top priority. Businesses must implement robust security measures to protect against data breaches and fraud.

- PCI Compliance: Meeting the requirements of PCI DSS can be complex and costly. Businesses must ensure their systems and processes comply with these standards.

- Choosing the Right Gateway: Selecting the appropriate payment gateway can be challenging, as different gateways offer different features, pricing models, and supported payment methods.

- Integration with Existing Systems: Integrating a payment gateway with existing e-commerce platforms, accounting software, and other systems can be complex and require careful planning.

- Testing and Debugging: Thorough testing is crucial to ensure that the payment gateway functions correctly and that transactions are processed accurately. Debugging any issues that arise can be time-consuming.

- Cost Considerations: Payment gateways charge fees for their services, which can include transaction fees, monthly fees, and other charges. Businesses must carefully consider these costs when choosing a gateway.

Understanding Payment Gateway Providers

Selecting the right payment gateway provider is a crucial decision for any business processing online transactions. This choice impacts not only the ease of integration but also the cost of processing payments, the geographic reach, and the security measures implemented. Understanding the offerings of different providers allows businesses to make informed decisions that align with their specific needs and goals.

Leading Payment Gateway Providers in the Market

The payment gateway landscape is competitive, with several established and emerging players vying for market share. These providers offer a range of features and cater to different business sizes and requirements.

- Stripe: Known for its developer-friendly API, Stripe is a popular choice for businesses of all sizes. It offers a comprehensive suite of tools, including payment processing, subscription management, and fraud prevention.

- PayPal: A widely recognized name, PayPal provides a user-friendly interface and global reach. It is particularly well-suited for businesses that want to offer a familiar payment option to their customers.

- Authorize.Net: A long-standing player in the industry, Authorize.Net provides robust payment processing solutions, often favored by businesses that require advanced security features and integration with existing systems.

- Square: Primarily known for its point-of-sale (POS) systems, Square also offers payment gateway services, particularly appealing to businesses that need an integrated solution for both online and in-person transactions.

- Braintree (a PayPal service): Braintree offers a comprehensive platform for processing payments, including support for various payment methods and currencies. It is often chosen by businesses looking for scalability and advanced features.

Features and Functionalities Offered by Different Providers

Payment gateway providers offer a variety of features designed to streamline the payment process and enhance the user experience. The specific features vary depending on the provider.

- Payment Processing: This is the core function, enabling businesses to accept credit card payments, debit card payments, and other payment methods.

- Recurring Billing: Allows businesses to set up automated billing for subscriptions or recurring payments.

- Fraud Prevention: Providers employ various techniques, such as address verification systems (AVS) and card verification value (CVV) checks, to detect and prevent fraudulent transactions.

- Reporting and Analytics: Provide businesses with insights into their sales, payment trends, and other key metrics.

- Mobile Payments: Support for mobile payment methods, such as Apple Pay and Google Pay, is becoming increasingly important.

- International Payments: Enables businesses to accept payments from customers worldwide, often with support for multiple currencies.

- Integration Options: Different integration methods, such as APIs, SDKs, and pre-built plugins, allow businesses to easily integrate the payment gateway into their websites or applications.

Pricing Structures of Various Payment Gateway Providers

Payment gateway providers typically employ different pricing models, including transaction fees, monthly fees, and setup fees. Understanding these costs is essential for budgeting and choosing the most cost-effective solution.

- Transaction Fees: A percentage of each transaction is charged. This is the most common pricing model. For example, a provider might charge 2.9% + $0.30 per transaction.

- Monthly Fees: Some providers charge a monthly fee, regardless of the number of transactions. This fee may cover features like advanced reporting or customer support.

- Setup Fees: Some providers charge a one-time fee for setting up an account.

- Additional Fees: Businesses may also incur additional fees for services like chargebacks or international transactions.

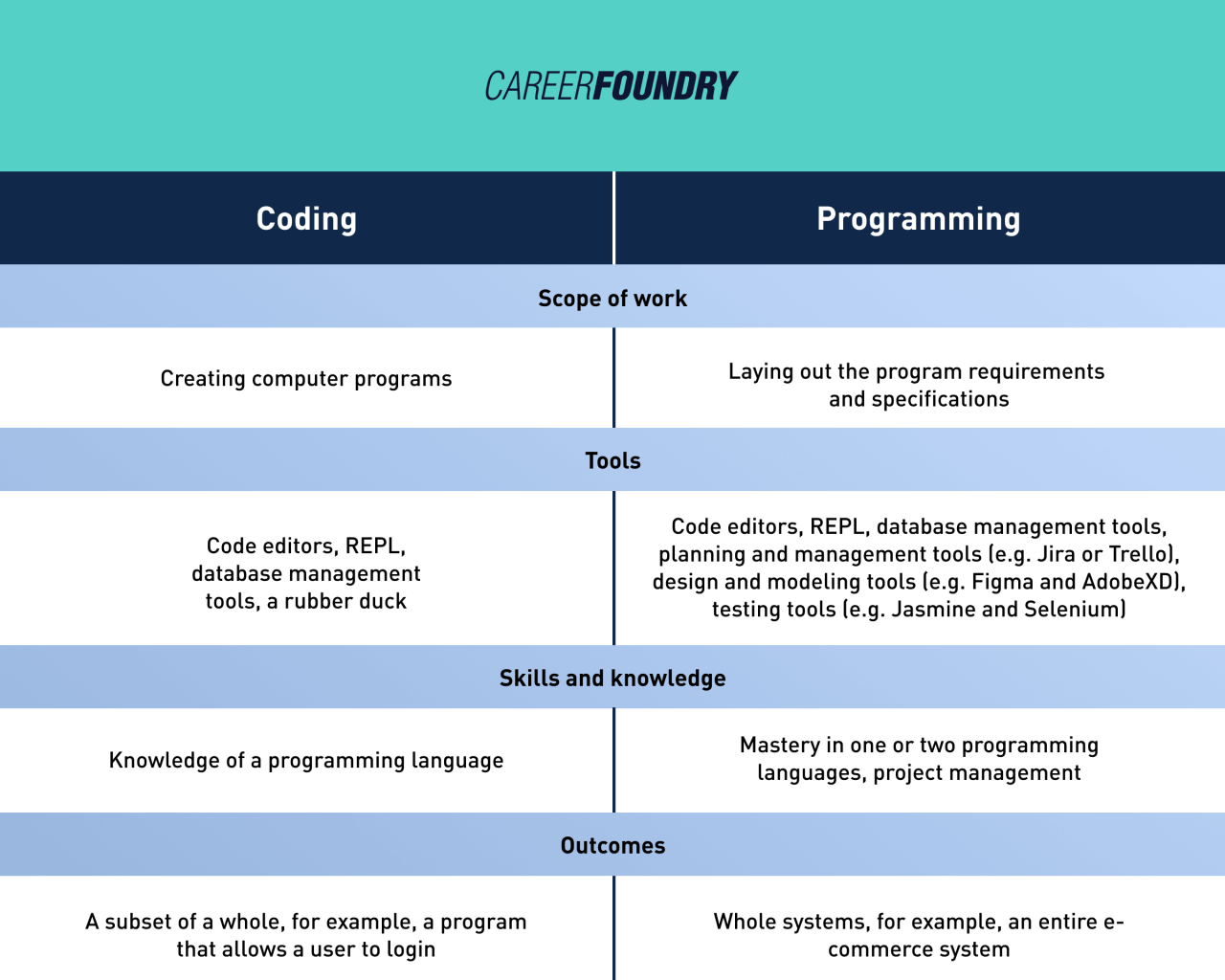

Comparison of Stripe, PayPal, and Authorize.Net

The following table provides a comparison of transaction fees, supported currencies, and integration methods for Stripe, PayPal, and Authorize.Net. This information is subject to change; it’s essential to check the provider’s official website for the most up-to-date pricing and features.

| Feature | Stripe | PayPal | Authorize.Net |

|---|---|---|---|

| Transaction Fees (Standard) | 2.9% + $0.30 per successful card charge | 2.99% + fixed fee (varies by currency) | 2.9% + $0.30 per transaction (with a merchant account) |

| Supported Currencies | 135+ currencies | 25+ currencies | 190+ currencies |

| Integration Methods | API, SDKs, pre-built plugins for various platforms | API, pre-built plugins for various platforms, hosted checkout pages | API, SDKs, pre-built plugins for various platforms, hosted payment form |

Choosing the Right Payment Gateway

Selecting the right payment gateway is a crucial decision for any business accepting online payments. It directly impacts the customer experience, security of transactions, and overall operational efficiency. This section Artikels the key factors to consider when choosing a payment gateway, ensuring you make an informed decision that aligns with your business needs.

Factors to Consider When Selecting a Payment Gateway

Several factors contribute to the suitability of a payment gateway for your business. Carefully evaluating these aspects will help you choose a provider that offers the best combination of features, security, and cost-effectiveness.

- Transaction Fees and Pricing Structure: Payment gateways employ various pricing models. Some charge a percentage of each transaction, while others have monthly fees, setup fees, or tiered pricing based on transaction volume. Understanding the fee structure is vital to estimate the overall cost and its impact on your profitability. For example, a small business with a low transaction volume might find a flat monthly fee more economical than a per-transaction fee.

Consider the following:

- Transaction fees (percentage and fixed fee per transaction).

- Monthly fees and setup fees.

- Pricing tiers based on transaction volume.

- Hidden fees (e.g., chargeback fees, currency conversion fees).

- Supported Payment Methods: The payment gateway should support the payment methods your customers prefer. Offering a variety of payment options can significantly improve conversion rates and cater to a broader customer base. Consider:

- Credit and debit cards (Visa, Mastercard, American Express, Discover).

- E-wallets (PayPal, Apple Pay, Google Pay, etc.).

- Bank transfers.

- Alternative payment methods (e.g., local payment options in your target markets).

- Security Features: Security is paramount. The payment gateway must provide robust security measures to protect sensitive cardholder data and prevent fraud. This includes:

- Encryption: Data encryption during transmission and storage.

- Fraud Prevention Tools: Tools to detect and prevent fraudulent transactions.

- 3D Secure: Support for 3D Secure authentication (Verified by Visa, Mastercard SecureCode) to reduce chargebacks.

- Tokenization: Tokenization to replace sensitive card data with a unique token.

- Integration Capabilities: The gateway should seamlessly integrate with your existing e-commerce platform, shopping cart, and other business systems.

- API and SDKs: Availability of well-documented APIs and SDKs for easy integration.

- Platform Compatibility: Compatibility with your e-commerce platform (e.g., Shopify, WooCommerce, Magento).

- Customization Options: Flexibility to customize the payment process to match your brand.

- Customer Support: Reliable and responsive customer support is essential, especially when dealing with technical issues or transaction disputes.

- Availability: 24/7 support availability.

- Support Channels: Support via phone, email, and chat.

- Response Time: Prompt response times to inquiries.

- Documentation: Comprehensive documentation and FAQs.

- Reporting and Analytics: The gateway should provide detailed reporting and analytics to help you track transactions, identify trends, and optimize your payment processes.

- Transaction Reports: Detailed transaction reports.

- Sales Analytics: Sales analytics dashboards.

- Fraud Detection Reporting: Fraud detection reports.

- Customizable Reports: Ability to create custom reports.

- International Payments: If you plan to sell internationally, the gateway should support multiple currencies and offer features to handle cross-border transactions.

- Currency Conversion: Automatic currency conversion.

- International Payment Methods: Support for local payment methods in different countries.

- Compliance with International Regulations: Compliance with international financial regulations.

Importance of Security and Compliance (PCI DSS)

Security and compliance are non-negotiable aspects of payment gateway selection. Protecting sensitive cardholder data is crucial to maintain customer trust, prevent financial losses, and avoid legal repercussions.

- Payment Card Industry Data Security Standard (PCI DSS): PCI DSS is a set of security standards designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. Choosing a PCI DSS compliant payment gateway is essential.

PCI DSS compliance is not just a technical requirement; it’s a fundamental responsibility to protect customer data.

- Compliance Levels: The level of compliance required depends on the volume of transactions processed.

- Security Measures: PCI DSS mandates various security measures, including firewalls, encryption, access control, and regular security audits.

- Data Encryption: Encryption is the process of converting sensitive data into a coded format to prevent unauthorized access. Payment gateways must encrypt sensitive cardholder data both during transmission (e.g., using SSL/TLS) and storage.

- SSL/TLS Certificates: Secure Sockets Layer (SSL) and Transport Layer Security (TLS) certificates encrypt the communication between the customer’s browser and the payment gateway server.

- Tokenization: Tokenization replaces sensitive card data with a unique token, which reduces the risk of data breaches.

- Fraud Prevention: Payment gateways employ various fraud prevention tools to detect and prevent fraudulent transactions.

- Address Verification System (AVS): AVS verifies the billing address provided by the customer with the address on file with the card issuer.

- Card Verification Value (CVV): CVV is a three or four-digit security code located on the back of the credit card.

- Fraud Scoring: Fraud scoring systems analyze various factors (e.g., transaction amount, location, IP address) to assign a risk score to each transaction.

- 3D Secure Authentication: 3D Secure (3-Domain Secure) is a security protocol that adds an extra layer of security to online credit and debit card transactions. It requires the cardholder to authenticate their identity with the card issuer, usually via a one-time password.

- Verified by Visa and Mastercard SecureCode: 3D Secure is implemented under different brand names, such as Verified by Visa and Mastercard SecureCode.

- Reduced Chargebacks: 3D Secure helps reduce chargebacks by shifting liability to the card issuer.

Significance of Supported Payment Methods

Offering a wide range of supported payment methods is crucial for maximizing sales and providing a positive customer experience. Different customers have different preferences, and providing diverse payment options can significantly increase conversion rates.

- Credit and Debit Cards: Credit and debit cards are the most widely accepted payment methods globally.

- Visa and Mastercard: These are the most popular card networks worldwide.

- American Express and Discover: These card networks are also widely used, particularly in the United States.

- E-wallets: E-wallets are digital wallets that allow customers to store their payment information and make online payments without entering their card details each time.

- PayPal: PayPal is a popular e-wallet that allows users to send and receive money online.

- Apple Pay and Google Pay: These mobile payment platforms enable customers to make payments using their smartphones or other devices.

- Bank Transfers: Bank transfers allow customers to pay directly from their bank accounts.

- ACH Payments (in the US): Automated Clearing House (ACH) payments are a common form of bank transfer in the United States.

- SEPA Transfers (in Europe): Single Euro Payments Area (SEPA) transfers facilitate bank transfers within the European Union.

- Alternative Payment Methods: These are payment methods that are popular in specific regions or countries.

- Local Payment Options: Supporting local payment options can be essential for businesses targeting specific markets. For example, iDEAL in the Netherlands, or Alipay and WeChat Pay in China.

- Buy Now, Pay Later (BNPL): BNPL services, such as Klarna and Afterpay, allow customers to pay for purchases in installments. These are gaining popularity, especially among younger consumers.

Checklist for Evaluating Payment Gateway Providers

Creating a checklist can help you systematically evaluate different payment gateway providers and ensure you choose the one that best meets your business requirements.

| Category | Criteria | Evaluation | Notes |

|---|---|---|---|

| Pricing and Fees | Transaction fees | Compare rates from different providers. | Consider both percentage and fixed fees. |

| Monthly fees | Evaluate whether monthly fees are justifiable. | Factor in setup fees, if any. | |

| Hidden fees | Inquire about potential hidden fees (e.g., chargeback fees). | Clarify any currency conversion fees. | |

| Payment Methods | Credit and debit cards | Verify support for major card networks (Visa, Mastercard, etc.). | Ensure support for American Express and Discover if needed. |

| E-wallets | Confirm support for popular e-wallets (PayPal, Apple Pay, Google Pay). | Assess compatibility with specific e-wallets relevant to your target market. | |

| Bank transfers | Check for support for bank transfer options (ACH, SEPA, etc.). | Consider local payment options relevant to your target market. | |

| Alternative payment methods | Evaluate support for relevant alternative payment methods. | Consider Buy Now, Pay Later (BNPL) options. | |

| Security and Compliance | PCI DSS compliance | Confirm the provider’s PCI DSS compliance level. | Inquire about the provider’s security practices and certifications. |

| Encryption | Verify the use of encryption (SSL/TLS) for data transmission. | Confirm tokenization options. | |

| Fraud prevention | Assess the availability of fraud prevention tools (AVS, CVV, fraud scoring). | Inquire about 3D Secure support. | |

| Integration and Features | API and SDKs | Assess the quality and documentation of APIs and SDKs. | Ensure ease of integration with your platform. |

| Platform compatibility | Verify compatibility with your e-commerce platform. | Check for available plugins or integrations. | |

| Customization | Evaluate the ability to customize the payment process. | Consider branding options. | |

| Customer Support | Availability | Confirm the availability of 24/7 support. | Assess the support channels (phone, email, chat). |

| Response time | Evaluate the typical response time for inquiries. | Assess the quality of documentation and FAQs. | |

| Reporting and Analytics | Transaction reports | Verify the availability of detailed transaction reports. | Assess the clarity and usefulness of reports. |

| Sales analytics | Evaluate the availability of sales analytics dashboards. | Assess the ability to create custom reports. | |

| International Payments | Currency conversion | Verify the support for automatic currency conversion. | Assess the fees associated with currency conversion. |

| International payment methods | Confirm support for local payment methods in your target markets. | Ensure compliance with international regulations. |

Integration Methods and Technologies

Integrating a payment gateway involves selecting the appropriate method and technology to ensure secure and seamless transactions. The choice depends on factors such as the complexity of the application, security requirements, and development resources. This section explores various integration methods and the technologies commonly employed.

Different Integration Methods

Several methods exist for integrating payment gateways, each with its own advantages and disadvantages. Understanding these options allows developers to choose the best fit for their specific needs.

- API (Application Programming Interface): APIs allow direct communication with the payment gateway’s servers. This method offers the most flexibility and control over the payment process, enabling developers to customize the user experience. The integration involves sending requests to the payment gateway’s API endpoints to initiate transactions, handle payment confirmations, and manage refunds.

- SDK (Software Development Kit): SDKs provide pre-built code libraries and tools that simplify the integration process. They encapsulate the complexities of interacting with the payment gateway’s API, offering functionalities such as payment form generation, fraud detection, and secure data transmission. SDKs are available for various programming languages and platforms, making integration faster and easier.

- Hosted Payment Pages: Hosted payment pages redirect users to a payment gateway’s secure website to enter their payment information. This method reduces the scope of PCI DSS compliance for the merchant, as the payment gateway handles the sensitive data. Once the payment is processed, the user is redirected back to the merchant’s website. This method is simpler to implement, but offers less control over the user experience.

Popular Programming Languages and Frameworks

Various programming languages and frameworks are used for integrating payment gateways. The choice of technology depends on the existing infrastructure and the specific requirements of the application.

- Python: Python is a versatile and widely used language, known for its readability and extensive libraries. Frameworks like Django and Flask simplify web development, making it a popular choice for payment gateway integration.

- JavaScript: JavaScript, especially with frameworks like React, Angular, and Vue.js, is essential for front-end development and creating interactive payment forms. JavaScript is often used in conjunction with back-end languages to handle payment processing.

- PHP: PHP is a server-side scripting language commonly used for web development. Frameworks like Laravel and Symfony provide tools and libraries for integrating payment gateways and managing transactions.

- Java: Java is a robust and scalable language used in enterprise applications. Frameworks like Spring and Struts provide tools for building secure and reliable payment processing systems.

- Ruby: Ruby, with its framework Ruby on Rails, offers a developer-friendly environment for building web applications, including payment gateway integration.

Steps for API Integration

Integrating a payment gateway using an API involves several key steps. Each step is crucial for ensuring secure and successful payment processing.

- Obtain API Credentials: Register with the payment gateway provider and obtain the necessary API keys (e.g., API key, secret key, merchant ID). These credentials are used to authenticate requests to the payment gateway.

- Install the SDK or Library (if available): Many payment gateway providers offer SDKs or libraries for popular programming languages. Install the relevant package using a package manager (e.g., pip for Python, npm for JavaScript). If an SDK isn’t available, you’ll typically make direct API calls using an HTTP client.

- Create a Payment Form: Design a payment form to collect the necessary payment information from the customer, such as credit card details, billing address, and shipping information. Ensure the form is secure and uses HTTPS to encrypt the data.

- Collect Payment Information: Securely collect payment information from the customer. This can involve using a secure payment form provided by the payment gateway or tokenizing sensitive data.

- Send Payment Request: Construct an API request to the payment gateway, including the payment information, amount, currency, and any other required parameters.

- Handle API Response: The payment gateway will return a response indicating the status of the transaction (e.g., success, failure, pending). Parse the response and handle it appropriately, such as displaying a success message or an error message to the customer.

- Implement Webhooks (optional but recommended): Set up webhooks to receive real-time notifications from the payment gateway about transaction events, such as payment confirmations, refunds, and chargebacks. This allows for asynchronous processing of these events.

- Test the Integration: Thoroughly test the integration using test API keys and test card numbers provided by the payment gateway provider. Verify that payments are processed correctly and that all aspects of the integration function as expected.

- Go Live: Once testing is complete, switch to live API keys and begin processing real transactions.

Example Python Code Snippet

The following Python code snippet demonstrates a basic API call for payment processing using the `requests` library. This example assumes the payment gateway’s API uses a POST request and JSON format.

import requests

import json

# Replace with your actual API endpoint and credentials

API_ENDPOINT = "https://example.com/api/payments"

API_KEY = "YOUR_API_KEY"

MERCHANT_ID = "YOUR_MERCHANT_ID"

def process_payment(amount, currency, card_number, expiry_date, cvv):

payload =

"merchant_id": MERCHANT_ID,

"amount": amount,

"currency": currency,

"card_number": card_number,

"expiry_date": expiry_date,

"cvv": cvv

headers =

"Content-Type": "application/json",

"Authorization": f"Bearer API_KEY"

try:

response = requests.post(API_ENDPOINT, data=json.dumps(payload), headers=headers)

response.raise_for_status() # Raise HTTPError for bad responses (4xx or 5xx)

response_data = response.json()

print(f"Payment processed successfully: response_data")

return response_data

except requests.exceptions.RequestException as e:

print(f"Payment processing failed: e")

return None

# Example usage

payment_result = process_payment(amount=10.00, currency="USD", card_number="1234567890123456", expiry_date="12/25", cvv="123")

if payment_result:

print("Payment successful!")

else:

print("Payment failed.")

Security Considerations

Integrating payment gateways necessitates a paramount focus on security. The handling of sensitive financial data makes payment integration a prime target for malicious actors. Implementing robust security measures is not just a best practice; it’s a legal and ethical imperative. Failure to do so can lead to severe consequences, including financial losses, reputational damage, and legal repercussions.

Secure Coding Practices

Secure coding practices form the foundation of a secure payment gateway integration. These practices involve writing code that is resilient to common vulnerabilities and designed to protect sensitive data. This requires a proactive approach, incorporating security considerations throughout the entire development lifecycle.

- Input Validation: Always validate and sanitize all user inputs to prevent injection attacks (e.g., SQL injection, cross-site scripting). This includes data received from forms, APIs, and other sources. For example, if accepting a credit card number, ensure it conforms to the expected format and length.

- Output Encoding: Properly encode all output data to prevent cross-site scripting (XSS) attacks. This ensures that malicious scripts injected into the system cannot be executed in a user’s browser.

- Authentication and Authorization: Implement strong authentication mechanisms (e.g., multi-factor authentication) to verify user identities. Ensure proper authorization to control access to sensitive resources and functionalities.

- Session Management: Securely manage user sessions to prevent session hijacking. Use secure session cookies, implement proper session timeouts, and regularly regenerate session IDs.

- Error Handling: Handle errors gracefully and avoid displaying sensitive information in error messages. Provide informative, yet non-revealing, error messages to the user.

- Regular Security Audits: Conduct regular security audits and penetration testing to identify and address vulnerabilities. Employ static and dynamic analysis tools to detect potential security flaws in the code.

- Keep Software Updated: Regularly update all software components, including libraries, frameworks, and the operating system, to patch known vulnerabilities. Implement a process for promptly applying security patches.

Encryption and Tokenization in Payment Processing

Encryption and tokenization are critical security mechanisms used to protect sensitive cardholder data during payment processing. They provide layers of security, mitigating the risks associated with data breaches and unauthorized access.

- Encryption: Encryption transforms sensitive data into an unreadable format, protecting it from unauthorized access. Data is encrypted using cryptographic algorithms and a secret key. Only authorized parties with the correct key can decrypt the data. In payment processing, encryption is used to secure data in transit (e.g., between the customer’s browser and the payment gateway) and at rest (e.g., in databases).

For example, when a customer enters their credit card information on a website, the data is encrypted using Transport Layer Security (TLS) or Secure Sockets Layer (SSL) protocols.

- Tokenization: Tokenization replaces sensitive cardholder data (e.g., credit card numbers) with a unique, randomly generated value called a token. This token is then used in place of the actual card data for processing payments. The token is meaningless to anyone who doesn’t have access to the secure token vault where the real card data is stored. This reduces the risk of data breaches because the sensitive card data is not stored or transmitted.

For instance, when a customer saves their credit card information for future purchases, the payment gateway generates a token for the card number and securely stores the token. Subsequent transactions use the token instead of the actual card number.

Handling Sensitive Data Securely

Handling sensitive data securely is paramount to protect against data breaches and comply with industry regulations such as PCI DSS (Payment Card Industry Data Security Standard). This involves implementing a multi-layered approach to protect sensitive cardholder data.

- Minimize Data Storage: Store only the minimum amount of sensitive data necessary. Avoid storing full credit card numbers if possible.

- Secure Storage: If sensitive data must be stored, encrypt it using strong encryption algorithms and store it in a secure and compliant environment. Use hardware security modules (HSMs) for key management.

- Access Control: Implement strict access controls to limit access to sensitive data to only authorized personnel. Use role-based access control (RBAC) to grant access based on job function.

- Data Masking and Anonymization: Mask or anonymize sensitive data in development and testing environments to prevent accidental exposure.

- Regular Data Audits: Conduct regular audits to ensure data security practices are being followed and to identify any potential vulnerabilities.

- Compliance with PCI DSS: Adhere to the PCI DSS requirements, which include security policies, procedures, and technical measures for handling cardholder data.

Steps to Prevent Common Security Vulnerabilities During Integration:

- Conduct a thorough security assessment: Before starting integration, identify potential vulnerabilities specific to the payment gateway and the application.

- Use a secure development framework: Utilize frameworks with built-in security features and follow secure coding guidelines.

- Implement proper input validation and output encoding: Prevent injection attacks and cross-site scripting.

- Encrypt all sensitive data: Protect data both in transit and at rest.

- Use tokenization: Reduce the risk of storing and transmitting sensitive cardholder data.

- Implement strong authentication and authorization: Secure access to payment processing functionalities.

- Regularly update software and libraries: Patch known vulnerabilities.

- Conduct regular security audits and penetration testing: Identify and address vulnerabilities.

- Comply with PCI DSS requirements: Adhere to industry standards for secure payment processing.

Step-by-Step Integration Process

Integrating a payment gateway involves a series of crucial steps to ensure secure and seamless transactions. A well-defined process minimizes errors, protects sensitive data, and provides a positive user experience. This section Artikels a practical guide for integrating a payment gateway, covering the general steps, setting up a test environment, handling payment confirmations, and visualizing the workflow.

General Steps Involved in Integrating a Payment Gateway

The process of integrating a payment gateway can be broken down into several key stages. Following these steps will help ensure a smooth and successful integration.

- Choose a Payment Gateway Provider: This involves researching and selecting a provider that meets your business needs in terms of features, pricing, supported currencies, and geographic coverage. Consider factors like transaction fees, security features, and customer support.

- Create an Account and Obtain API Credentials: Once you’ve chosen a provider, you’ll need to create an account and obtain the necessary API keys, secret keys, and other credentials required to interact with the payment gateway’s systems. These credentials are crucial for authentication.

- Select an Integration Method: Decide on the appropriate integration method based on your technical capabilities and business requirements. Common methods include direct API integration, hosted payment pages, and pre-built plugins.

- Implement the Integration: Write the code to integrate the payment gateway into your website or application. This involves using the API to create payment requests, handle responses, and process transactions.

- Set Up a Test Environment: Use the payment gateway’s test environment (sandbox) to simulate transactions and verify that the integration works correctly without affecting real funds.

- Test the Integration Thoroughly: Conduct comprehensive testing, including positive and negative test cases, to ensure the integration handles various scenarios, such as successful payments, declined transactions, and errors.

- Implement Security Measures: Implement security best practices, such as encrypting sensitive data, using secure connections (HTTPS), and following PCI DSS compliance guidelines.

- Go Live and Monitor Transactions: Once testing is complete, switch to the live environment. Continuously monitor transactions, address any issues promptly, and maintain the integration.

- Implement Webhooks (Optional but Recommended): Configure webhooks to receive real-time notifications about payment events, such as successful payments, refunds, and chargebacks. This enables immediate responses to transaction events.

Detailed Procedure for Setting Up a Test Environment

Setting up a test environment is a crucial step in payment gateway integration. It allows developers to simulate transactions and ensure the integration functions correctly without impacting real funds.

The following procedure Artikels how to set up a test environment:

- Access the Test Environment: Most payment gateway providers offer a dedicated test environment (often called a sandbox) that mimics the live environment. You’ll typically access this environment through a separate set of API credentials.

- Obtain Test Credentials: Obtain test API keys and credentials from the payment gateway provider. These credentials will be different from your live account credentials.

- Configure Test URLs: Use the test environment’s URLs for all API calls and payment page redirects during testing. These URLs will differ from the production (live) URLs.

- Use Test Card Numbers: Payment gateways provide test card numbers and expiry dates that simulate various transaction outcomes (e.g., successful payments, declined payments, insufficient funds). Use these test card numbers to simulate different scenarios.

- Test Payment Flows: Simulate different payment flows, including successful payments, declined transactions, refunds, and chargebacks. Verify that your system handles each scenario correctly.

- Verify Notifications and Webhooks: Test the receipt of payment confirmations, error notifications, and webhook events in the test environment. Ensure that your system processes these notifications correctly.

- Test with Different Scenarios: Test various scenarios, such as different payment amounts, currencies, and card types, to ensure the integration is robust.

- Review Logs and Debug: Regularly review the logs in both your system and the payment gateway’s test environment to identify and resolve any issues or errors.

- Document Test Cases: Document the test cases and their results for future reference and regression testing.

- Clear Test Data: Be aware that test data will not be visible in your live account. After completing testing, be sure to clear out any test data that is no longer needed.

Elaboration on How to Handle Payment Confirmations and Notifications

Handling payment confirmations and notifications is essential for providing users with timely and accurate information about their transactions. This involves processing responses from the payment gateway and notifying both the merchant and the customer.

The following are key aspects of handling payment confirmations and notifications:

- Payment Confirmation from the Gateway: Upon successful payment, the payment gateway sends a confirmation message, often via a redirect or an API response. This message includes transaction details, such as the transaction ID, amount, and status.

- Update Your Database: Upon receiving the payment confirmation, update your database with the transaction details, including the payment status (e.g., “completed,” “pending,” “failed”).

- Send Confirmation to the Customer: Send an email or display an on-screen confirmation to the customer, confirming the successful payment. This confirmation should include transaction details, such as the order number, amount, and payment method.

- Implement Webhooks for Real-time Updates: Webhooks provide real-time notifications about payment events. Configure webhooks to receive notifications for events such as successful payments, refunds, and chargebacks.

- Handle Payment Status Updates: Continuously monitor the payment status. If the payment status changes (e.g., from “pending” to “completed”), update your system accordingly.

- Handle Declined Transactions: If a transaction is declined, notify the customer and provide instructions on how to resolve the issue. This might involve checking card details or contacting their bank.

- Handle Refunds and Chargebacks: Implement procedures for handling refunds and chargebacks. When a refund is initiated, update the transaction status and notify the customer. In the case of a chargeback, gather necessary documentation to dispute the charge.

- Implement Retry Mechanisms (if necessary): For transactions that initially fail due to temporary issues (e.g., network problems), implement retry mechanisms to attempt the transaction again after a short delay.

- Security Measures: Ensure all communications are secure, using HTTPS for all requests and responses. Validate all data received from the payment gateway to prevent manipulation.

Design a Flowchart Illustrating the Payment Processing Workflow

A flowchart provides a visual representation of the payment processing workflow, which helps understand the steps involved in a payment transaction. The flowchart shows the path of a payment from the customer’s initiation to the final confirmation.

Here’s a description of the payment processing workflow, which could be represented by a flowchart:

- Customer Initiates Payment: The customer selects items, enters their payment information (card details, etc.), and clicks the “Pay” button on your website or application.

- Payment Request Sent to Gateway: Your system sends a payment request to the payment gateway, including the transaction details (amount, currency, order ID, customer information, etc.).

- Gateway Processes the Payment: The payment gateway processes the request, which involves validating the card details, checking for sufficient funds, and authorizing the transaction with the customer’s bank.

- Gateway Sends Response: The payment gateway sends a response to your system, indicating the transaction’s status (e.g., “approved,” “declined,” “pending”).

- Handle Approved Transactions: If the transaction is approved:

- Update Your Database: Your system updates the order status to “paid” or “processing.”

- Send Confirmation to Customer: An email confirmation is sent to the customer with the order details.

- Trigger Fulfillment: Begin the order fulfillment process (e.g., shipping the product or providing access to the service).

- Handle Declined Transactions: If the transaction is declined:

- Notify the Customer: Inform the customer about the declined transaction and the reasons (e.g., insufficient funds, incorrect card details).

- Provide Retry Options: Offer the customer options to retry the payment, use a different payment method, or contact customer support.

- Handle Pending Transactions: If the transaction is pending:

- Monitor Status: Regularly check the payment status with the payment gateway until it is either approved or declined.

- Hold Order Fulfillment: Delay order fulfillment until the payment is confirmed.

- Webhooks (Optional): The payment gateway can send real-time updates through webhooks for events such as payment completion, refunds, or chargebacks. These events can trigger immediate actions in your system.

- Reporting and Reconciliation: Regularly reconcile transactions, generate reports, and address any discrepancies.

Testing and Debugging

Thorough testing is crucial before launching a payment gateway integration to ensure a smooth and secure user experience. This process validates the integration’s functionality, security, and compatibility across different scenarios and environments. Rigorous testing minimizes the risk of payment failures, data breaches, and reputational damage. Neglecting this stage can lead to significant financial losses and erode customer trust.

Simulating Payment Scenarios

Simulating various payment scenarios is a fundamental part of testing. This process allows developers to verify the integration’s behavior under different conditions without risking real transactions. These simulations should cover a wide range of scenarios to ensure the robustness of the integration.

- Successful Transactions: Test the standard flow of a successful payment, verifying that funds are correctly processed and that the system updates accordingly. This includes testing with different card types, currencies, and amounts.

- Failed Transactions: Simulate scenarios that lead to payment failures, such as insufficient funds, incorrect card details, expired cards, or declined transactions by the bank. This ensures that the system handles these errors gracefully and provides appropriate feedback to the user.

- Refunds and Partial Refunds: Test the refund process, including both full and partial refunds. Verify that the correct amounts are refunded and that the system accurately reflects these changes.

- Recurring Payments: If the integration supports recurring payments, test the setup, processing, and cancellation of subscriptions. Verify that the system handles renewals and failed recurring payments correctly.

- Fraudulent Transactions: Simulate potentially fraudulent transactions to test the integration’s fraud detection capabilities. This includes testing with suspicious card details or transaction patterns.

- Different Devices and Browsers: Test the integration on various devices (desktops, mobile phones, tablets) and browsers (Chrome, Firefox, Safari, Edge) to ensure cross-platform compatibility.

- Network Issues: Simulate network outages or slow connections to verify how the integration handles these situations. Ensure the system provides appropriate error messages and attempts to retry transactions if necessary.

Debugging Common Integration Issues

Debugging is an integral part of the integration process, and it involves identifying and resolving issues that arise during testing. Common issues include incorrect API calls, data format errors, and security vulnerabilities. A systematic approach to debugging is essential for efficient problem-solving.

- Logging: Implement comprehensive logging to record all API requests and responses, including timestamps, parameters, and error messages. This information is invaluable for tracing the flow of transactions and identifying the source of problems.

- Error Handling: Implement robust error handling to catch and manage exceptions gracefully. Provide clear and informative error messages to developers and users. Avoid displaying sensitive information in error messages.

- API Documentation: Carefully review the payment gateway’s API documentation for accurate implementation. Ensure all API calls are made correctly, and all required parameters are included.

- Testing Tools: Use testing tools like Postman or Insomnia to send API requests and verify responses. These tools can help isolate issues and test individual API endpoints.

- Version Control: Utilize version control systems like Git to track changes to the codebase. This allows for easy rollback to previous versions if problems arise.

- Code Reviews: Conduct code reviews to identify potential errors and ensure adherence to coding standards and security best practices.

- Third-Party Libraries and SDKs: When using third-party libraries or SDKs, ensure they are up-to-date and compatible with the payment gateway’s API. Regularly update these components to benefit from bug fixes and security patches.

Common Error Codes and Their Meanings

Payment gateways use error codes to indicate the reason for transaction failures. Understanding these codes is crucial for debugging and providing appropriate feedback to users. Here is a list of common error codes and their meanings, though specific codes can vary between providers.

| Error Code | Meaning | Possible Cause | Resolution |

|---|---|---|---|

01 |

Invalid Card Number | The card number entered is invalid. | Verify the card number and re-enter it. |

05 |

Declined | The transaction was declined by the issuing bank. | Contact the bank to determine the reason for the decline. |

51 |

Insufficient Funds | The card does not have sufficient funds to complete the transaction. | Use a different card or deposit funds into the account. |

54 |

Expired Card | The card has expired. | Use a valid card. |

61 |

Exceeds Withdrawal Limit | The transaction exceeds the card’s withdrawal limit. | Contact the bank to increase the limit or use a different card. |

65 |

Exceeds Withdrawal Frequency Limit | The transaction exceeds the card’s withdrawal frequency limit. | Wait before attempting the transaction again. |

91 |

Issuer or Switch is Inoperative | The payment gateway or the card issuer is experiencing technical issues. | Try again later or contact the payment gateway support. |

96 |

System Error | A general system error has occurred. | Contact the payment gateway support. |

100 |

Invalid Transaction | The transaction is invalid. | Check the transaction details and retry. |

200 |

Transaction Approved | The transaction was successfully approved. | No action required. |

Handling Errors and Transactions

Managing errors and transactions effectively is crucial for providing a seamless and trustworthy payment experience. This involves anticipating potential issues, implementing strategies to mitigate their impact, and maintaining a transparent record of all financial activities. A robust error-handling system minimizes disruptions, builds customer confidence, and helps maintain compliance with industry regulations.

Handling Failed Transactions

Failed transactions are an inevitable part of payment processing. These failures can stem from various sources, including insufficient funds, incorrect card details, or issues with the payment gateway itself. Understanding the causes of these failures and implementing appropriate responses is essential.To address failed transactions, the following steps are critical:

- Identify the Reason for Failure: The payment gateway typically provides a specific error code or message indicating why a transaction failed. This information is invaluable for troubleshooting. For example, an error code like “Insufficient Funds” clearly identifies the problem.

- Inform the User: Provide clear and concise information to the user about the failure. Explain the reason in a user-friendly manner and suggest possible solutions. Avoid technical jargon. For example, instead of displaying “Error Code: 51,” state “Your payment was declined because of insufficient funds. Please check your balance or try another payment method.”

- Log the Error: Thoroughly log all failed transactions, including the error code, timestamp, user information, and transaction details. This log is crucial for debugging, identifying patterns, and preventing future issues.

- Offer Alternative Payment Methods: If a transaction fails, provide the user with alternative payment options. This might include trying a different card, using a digital wallet, or contacting customer support.

- Implement Automated Retries (with caution): Automated retries can be beneficial, but should be implemented carefully. Retry a failed transaction after a reasonable delay (e.g., a few minutes) in case the issue is temporary (e.g., a network glitch). Avoid retrying excessively, as this can annoy the user and potentially trigger fraud detection systems. Limit the number of retries.

- Consider User Experience: Design the error handling process with the user experience in mind. Provide helpful guidance and support to minimize frustration.

Implementing Retry Mechanisms

Retry mechanisms are designed to automatically attempt a failed transaction after a specified delay. They are particularly useful for addressing transient issues like temporary network outages or gateway glitches.Here’s how to implement retry mechanisms effectively:

- Define Retry Conditions: Determine under what circumstances a retry should be attempted. Generally, retry only for temporary errors, not for permanent failures like invalid card numbers. Error codes provided by the payment gateway are critical for making this determination.

- Implement Exponential Backoff: Use an exponential backoff strategy. This means increasing the delay between retry attempts. For example, retry after 1 minute, then after 2 minutes, then after 4 minutes, and so on. This prevents overwhelming the payment gateway.

- Set a Retry Limit: Limit the number of retries. After a certain number of attempts, the transaction should be considered failed. This prevents infinite loops.

- Log Retry Attempts: Log each retry attempt, including the timestamp, the reason for the retry, and the outcome. This helps with debugging and monitoring.

- Inform the User (if appropriate): Consider informing the user that the system is retrying the transaction. This can provide reassurance and manage expectations. Avoid excessive notifications.

- Handle Success and Failure: Implement logic to handle both successful and failed retries. If a retry is successful, update the transaction status and notify the user. If all retries fail, mark the transaction as failed and provide appropriate error messaging.

An example of exponential backoff would be:

Attempt 1: Wait 1 minute.Attempt 2: Wait 2 minutes.Attempt 3: Wait 4 minutes.Attempt 4: Wait 8 minutes.(Maximum Retries Reached – Transaction Failed)

Processing Refunds and Chargebacks

Refunds and chargebacks are essential aspects of payment processing. Refunds are initiated by the merchant, while chargebacks are initiated by the customer’s bank. Both require careful handling to ensure compliance and maintain financial stability.Here’s a breakdown of the process:

- Refunds:

- Initiation: The merchant initiates a refund through the payment gateway’s interface or API. This requires providing the original transaction ID and the refund amount.

- Processing: The payment gateway processes the refund, which typically involves crediting the customer’s account.

- Confirmation: The merchant receives confirmation of the refund, including the date and time of the refund.

- Notifications: The customer should receive a notification that the refund has been processed.

- Chargebacks:

- Dispute: The customer disputes a transaction with their bank.

- Notification: The merchant is notified of the chargeback by the payment gateway. This notification includes information about the dispute and the amount.

- Response: The merchant has a limited time (typically 30-60 days) to respond to the chargeback. The merchant must provide evidence to support the original transaction, such as proof of delivery, customer authorization, or terms of service.

- Review: The customer’s bank reviews the evidence provided by both the merchant and the customer.

- Decision: The bank makes a decision regarding the chargeback. The chargeback is either upheld (merchant loses) or reversed (merchant wins).

- Impact: If the chargeback is upheld, the merchant loses the funds and may incur fees. Chargebacks can also negatively impact the merchant’s chargeback ratio, potentially leading to higher fees or account restrictions.

- Best Practices for Refunds and Chargebacks:

- Clear Refund Policy: Establish a clear and concise refund policy and make it easily accessible to customers.

- Prompt Refunds: Process refunds quickly and efficiently.

- Accurate Records: Maintain detailed records of all transactions, including refunds and chargebacks.

- Respond to Chargebacks Promptly: Respond to chargebacks within the specified timeframe and provide all necessary evidence.

- Fraud Prevention: Implement fraud prevention measures to reduce the risk of chargebacks.

Best Practices for Managing Transaction Logs

Transaction logs are essential for auditing, troubleshooting, and compliance. Maintaining comprehensive and well-organized logs is crucial for effective payment processing management.Here are best practices for managing transaction logs:

- Comprehensive Data Capture: Log all relevant data for each transaction, including:

- Transaction ID

- Timestamp

- User information (e.g., customer ID, email address)

- Transaction amount

- Payment method

- Gateway response codes

- Error messages (if any)

- Transaction status (e.g., pending, successful, failed, refunded, chargeback)

- IP address and location of the transaction

- Secure Storage: Store transaction logs securely, protecting them from unauthorized access and modification. Consider encryption and access controls.

- Regular Backups: Implement a regular backup strategy to prevent data loss.

- Data Retention: Adhere to industry regulations and legal requirements regarding data retention. Retain transaction logs for the required period (e.g., several years).

- Searchable and Queryable: Design the logging system to allow for easy searching and querying of transaction data. This is essential for troubleshooting and auditing.

- Monitoring and Alerting: Implement monitoring and alerting to detect anomalies or suspicious activity in the transaction logs. For example, set up alerts for a sudden spike in failed transactions or chargebacks.

- Data Anonymization/Masking: Consider anonymizing or masking sensitive data (e.g., card numbers) in the logs to protect customer privacy while still retaining the necessary information for analysis.

- Regular Audits: Conduct regular audits of the transaction logs to ensure data integrity and compliance.

Compliance and Regulations

![[200+] Coding Backgrounds | Wallpapers.com [200+] Coding Backgrounds | Wallpapers.com](https://teknowise.web.id/wp-content/uploads/2025/10/coding-1024x836-16.jpg)

Adhering to payment regulations is paramount when integrating payment gateways. It ensures the security of financial transactions, protects sensitive customer data, and maintains legal compliance. Failure to comply can result in hefty fines, legal action, and reputational damage, ultimately impacting business operations and customer trust.

Adhering to Relevant Payment Regulations

Various regulations govern the processing of payments, varying by region and industry. Compliance is not merely a suggestion; it’s a legal requirement.

- Protecting Sensitive Data: Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate how businesses collect, store, and process customer data, including payment information. This includes requirements for data security, breach notification, and user consent.

- Preventing Fraud and Money Laundering: Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations require businesses to verify customer identities and monitor transactions to prevent financial crimes. This often involves screening transactions for suspicious activity and reporting any red flags to the appropriate authorities.

- Maintaining Financial Stability: Regulations like those enforced by the Financial Conduct Authority (FCA) in the UK aim to ensure the stability of the financial system. This includes requirements for financial institutions to maintain adequate capital reserves and manage risk effectively.

- Industry-Specific Regulations: Certain industries, such as healthcare (HIPAA in the US) and financial services (PSD2 in Europe), have specific regulations that businesses must adhere to when processing payments. These regulations may dictate how data is secured, how consent is obtained, and how transactions are authorized.

Requirements for PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder data. It’s not a law, but a set of industry requirements that businesses must adhere to if they accept, store, process, or transmit credit card information. Achieving and maintaining PCI DSS compliance is crucial for avoiding data breaches and maintaining customer trust.

- Scope of Compliance: The scope of PCI DSS compliance depends on the volume of credit card transactions processed annually and the way cardholder data is handled. Businesses are categorized into different levels based on these factors, each with varying compliance requirements.

- Twelve Core Requirements: PCI DSS comprises twelve core requirements, covering various aspects of data security. These requirements include:

- Installing and maintaining a firewall configuration to protect cardholder data.

- Changing vendor-supplied default passwords and other security parameters.

- Protecting stored cardholder data.

- Encrypting transmission of cardholder data across open, public networks.

- Protecting all systems against malware and regularly updating antivirus software or programs.

- Developing and maintaining secure systems and applications.

- Restricting access to cardholder data by business need-to-know.

- Assigning a unique ID to each person with computer access.

- Restricting physical access to cardholder data.

- Tracking and monitoring all access to network resources and cardholder data.

- Regularly testing security systems and processes.

- Maintaining a policy that addresses information security for all personnel.

- Validation and Compliance: Businesses must validate their PCI DSS compliance through various methods, including self-assessment questionnaires (SAQs), on-site assessments by a Qualified Security Assessor (QSA), and vulnerability scans. The specific validation method depends on the business’s transaction volume and level.

- Ongoing Compliance: PCI DSS compliance is not a one-time event. Businesses must continuously monitor and maintain their security posture to remain compliant. This includes regular vulnerability scans, penetration testing, and ongoing staff training.

The Role of Fraud Detection and Prevention

Fraud detection and prevention are essential components of a secure payment gateway integration. They involve implementing measures to identify and mitigate fraudulent activities, protecting both businesses and customers from financial losses.

- Fraud Detection Methods: Various methods are employed to detect fraudulent transactions.

- Transaction Monitoring: Analyzing transaction data in real-time to identify suspicious patterns, such as unusually large purchases, transactions from high-risk locations, or multiple transactions within a short period.

- Velocity Checks: Setting limits on the number of transactions or the amount of money that can be processed within a specific time frame to prevent fraudulent activity.

- Address Verification System (AVS): Comparing the billing address provided by the customer with the address on file with the credit card issuer to verify the customer’s identity.

- Card Verification Value (CVV) Checks: Requiring customers to enter the CVV code from the back of their credit card to verify they have physical possession of the card.

- 3D Secure (3DS): An authentication protocol that adds an extra layer of security by prompting the cardholder to verify their identity with their bank during online transactions.

- Machine Learning and AI: Utilizing machine learning algorithms to analyze transaction data and identify patterns indicative of fraud.

- Fraud Prevention Techniques: Various techniques are used to prevent fraudulent transactions.

- Implementing Strong Authentication: Requiring customers to use strong passwords and multi-factor authentication to access their accounts.

- Using Encryption: Encrypting sensitive data, such as cardholder information, to protect it from unauthorized access.

- Tokenization: Replacing sensitive cardholder data with unique tokens, which are used for processing transactions without exposing the actual card details.

- Setting Transaction Limits: Setting limits on the amount of money that can be transacted or the number of transactions that can be made within a specific time frame.

- Implementing Geolocation Blocking: Blocking transactions from high-risk countries or regions.

- Collaboration with Payment Providers: Payment gateway providers offer fraud detection and prevention tools, such as fraud scoring and risk analysis, to help businesses mitigate fraud. Businesses should work closely with their payment providers to leverage these tools and implement best practices.

Key Compliance Requirements for Different Regions

Different regions have distinct regulatory landscapes. Here’s a summary of key compliance requirements.

| Region | Key Regulations | Primary Focus |

|---|---|---|

| United States | PCI DSS, CCPA, HIPAA (for healthcare), AML/KYC | Data security, consumer privacy, and prevention of financial crimes. |

| European Union | GDPR, PSD2, AMLD5 | Data protection, secure payments, and anti-money laundering. |

| Asia-Pacific | Varies by country (e.g., PDPA in Singapore, APPI in Japan), PCI DSS | Data privacy, data security, and financial crime prevention. |

User Experience and Design

Creating a smooth and intuitive user experience during the payment process is crucial for boosting conversion rates and building customer trust. A poorly designed payment flow can lead to abandoned transactions, lost revenue, and negative brand perception. Therefore, careful consideration of user experience (UX) principles is essential when integrating payment gateways.

Creating a Seamless User Experience During the Payment Process

Providing a seamless payment experience involves minimizing friction points and guiding users effortlessly through the transaction. This requires a focus on simplicity, clarity, and efficiency.

- Reduce steps: Minimize the number of form fields and steps required to complete a payment. Unnecessary fields can frustrate users and lead to abandonment.

- Provide clear progress indicators: Show users their progress through the payment process, such as a progress bar or numbered steps. This helps manage expectations and reassures them that the transaction is ongoing.

- Offer multiple payment options: Cater to diverse user preferences by supporting various payment methods, including credit cards, debit cards, digital wallets (e.g., PayPal, Apple Pay, Google Pay), and local payment options.

- Ensure mobile responsiveness: Optimize the payment form for mobile devices, as a significant portion of online transactions occur on smartphones and tablets. Responsive design ensures a consistent and user-friendly experience across all screen sizes.

- Implement autofill: Leverage browser autofill capabilities to pre-populate form fields with user information, reducing the need for manual entry and saving time.

- Offer real-time validation: Validate form fields as users enter data, providing immediate feedback on errors and preventing submission of incomplete or incorrect information.

- Use clear and concise language: Avoid technical jargon and use straightforward language that is easy to understand. Provide clear instructions and error messages.

- Maintain visual consistency: Ensure that the payment form integrates seamlessly with the overall website design, maintaining a consistent look and feel to build trust and familiarity.

- Provide confirmation and receipts: After a successful payment, display a clear confirmation message and send a detailed receipt to the user’s email address.

The Importance of Clear and Concise Messaging

Clear and concise messaging is paramount in building trust and guiding users through the payment process. Ambiguous or confusing language can lead to errors, frustration, and ultimately, abandoned transactions.

- Label form fields clearly: Use descriptive labels that accurately identify the information required, such as “Card Number,” “Expiration Date,” and “CVV.”

- Provide helpful instructions: Offer brief and clear instructions for filling out each field, especially for less familiar information like the CVV.

- Use error messages effectively: When errors occur, provide specific and actionable error messages that explain the problem and guide the user on how to fix it. For example, instead of “Invalid card number,” provide “The card number you entered is invalid. Please check and try again.”

- Confirm the payment amount: Before the user submits the payment, clearly display the total amount being charged, including any applicable taxes or fees.

- Communicate security measures: Reassure users about the security of the payment process by displaying trust badges, security seals, and explanations of encryption methods.

- Use a consistent tone of voice: Maintain a consistent tone of voice throughout the payment process, reflecting the brand’s personality and values.

Examples of Well-Designed Payment Forms

Well-designed payment forms prioritize usability, security, and clarity. These forms typically incorporate best practices such as clear labeling, real-time validation, and a streamlined layout.

Example 1: Stripe’s Payment Form:

Stripe’s payment form is known for its clean and minimalist design. It uses inline validation, providing instant feedback as users enter information. The form is also mobile-responsive and supports various payment methods, creating a seamless experience.

Example 2: PayPal’s Checkout:

PayPal’s checkout is a widely recognized example of a user-friendly payment form. It allows users to pay with their PayPal account or as a guest using a credit or debit card. The form provides clear instructions and offers a secure payment environment.

Example 3: Square’s Payment Form:

Square’s payment form is known for its ease of use and focus on simplicity. It features a clean interface, clear instructions, and supports various payment methods. Square also provides detailed transaction summaries.

Design a Wireframe for a Responsive Payment Form

A wireframe serves as a blueprint for the payment form, outlining the layout and functionality. This wireframe is designed to be responsive, adapting to different screen sizes for optimal viewing on all devices.

Wireframe Elements:

- Logo and Branding: Top left corner displaying the company logo to reinforce brand identity.

- Progress Indicator: A visual representation of the payment steps (e.g., “1. Billing Address,” “2. Payment Details,” “3. Review”).

- Billing Address Section: Fields for name, address, city, state/province, zip code/postal code, and country.

- Payment Details Section: Fields for card number, expiration date, CVV, and cardholder name.

- Payment Method Selection: Clear buttons or icons to select payment methods (e.g., credit card, PayPal, Apple Pay).

- Order Summary: Displaying the items purchased, subtotal, shipping costs, taxes, and total amount.

- “Pay Now” Button: A prominent button that triggers the payment process.

- Security Badges: Trust badges (e.g., SSL certificate, PCI compliance) to reassure users.

- Error Messages: Displaying validation errors near the relevant fields.

Responsive Behavior:

- Mobile View: Stacked layout for form fields, larger font sizes, and a prominent “Pay Now” button.

- Tablet View: Two-column layout for some sections, such as billing address and payment details, to optimize space.

- Desktop View: Wider layout with sections arranged side-by-side, providing a more spacious design.

Illustrative Description of the Wireframe:

The wireframe would be illustrated using basic shapes and text to represent the elements described above. For example, a rectangle would represent the card number field, with the label “Card Number” above it. A progress bar would be displayed horizontally at the top. The order summary would be represented with a table showing item names, quantities, and prices. The “Pay Now” button would be a clearly defined rectangle, with the text “Pay Now” in a contrasting color.

Advanced Integration Features

Implementing advanced features significantly enhances the functionality and versatility of payment gateway integrations. These features move beyond basic transaction processing, offering capabilities that cater to complex business models and provide a superior user experience. This section delves into implementing recurring payments, integrating with e-commerce platforms, handling subscriptions, and the process of creating a custom payment gateway integration.

Implementing Recurring Payments

Recurring payments automate the process of billing customers on a regular schedule, such as monthly or annually, for subscription services, membership fees, or installment plans. This streamlines the payment process, reduces manual effort, and improves customer retention.To implement recurring payments, the following steps are generally involved:

- Choosing a Payment Gateway: Select a payment gateway that supports recurring billing. Popular choices include Stripe, PayPal, and Braintree, among others. Research each gateway’s features, pricing, and supported payment methods to determine the best fit for your business needs.

- Setting up Recurring Billing Plans: Within the chosen payment gateway’s dashboard or API, define the billing plans. This involves specifying the billing frequency (e.g., monthly, quarterly, annually), the amount to be charged, and any trial periods or setup fees.

- Tokenization: Securely store customer payment information (credit card details) using tokenization. The payment gateway provides a unique token that represents the customer’s payment information, allowing for future charges without storing sensitive data on your servers.

- Subscription Creation: When a customer subscribes to your service, create a subscription record in the payment gateway. This typically involves associating the customer’s token with the selected billing plan.

- Automated Billing: The payment gateway automatically processes payments according to the defined billing schedule. You will receive notifications regarding successful and failed transactions.

- Handling Failed Transactions: Implement mechanisms to handle failed transactions, such as sending email notifications to customers, retrying the charge, or allowing customers to update their payment information.

- Cancellation and Modification: Provide customers with options to cancel or modify their subscriptions easily. This typically involves API calls to the payment gateway to update or cancel the subscription.

Integrating with E-commerce Platforms

Integrating a payment gateway with an e-commerce platform allows businesses to accept online payments directly on their website. The integration process involves connecting the payment gateway to the platform’s checkout process.The integration process varies depending on the e-commerce platform. Here’s a general Artikel:

- Platform Selection: Choose an e-commerce platform that suits your business requirements. Popular platforms include Shopify, WooCommerce (for WordPress), Magento, and BigCommerce.

- Payment Gateway Compatibility: Ensure the chosen e-commerce platform is compatible with your preferred payment gateway. Most platforms offer built-in integrations or plugins for popular payment gateways.