Embarking on the journey of “how to coding invoice generator” unlocks a world of efficiency and professionalism for businesses of all sizes. This guide offers a comprehensive exploration of building your own invoice generator, moving beyond manual methods to embrace the power of automation. We’ll delve into the core components, technologies, and design principles needed to create a robust and user-friendly system.

From understanding the essential elements of an invoice to mastering database integration and UI/UX design, we’ll cover every step of the development process. You’ll learn how to incorporate tax calculations, generate professional templates, and provide customization options, empowering you to create invoices that reflect your brand and meet your specific needs. This guide will also address deployment, maintenance, and crucial aspects of testing and debugging.

Introduction: Understanding Invoice Generators

An invoice generator is a software application designed to automate the creation and management of invoices. It streamlines the billing process for businesses, enabling them to request payments from clients for goods or services rendered. By automating the creation of invoices, these tools reduce manual effort, improve accuracy, and accelerate the payment cycle.Using an invoice generator offers several advantages over manual invoicing methods, such as using spreadsheets or word processors.

These benefits contribute to increased efficiency and professionalism in managing financial transactions.

Core Purpose of Invoice Generators

The primary function of an invoice generator is to create professional-looking invoices quickly and efficiently. These applications are designed to eliminate the time-consuming and error-prone nature of manual invoice creation. Invoice generators typically include templates, customization options, and automation features that simplify the billing process. They allow businesses to:

- Generate invoices: Create invoices with all the necessary details, including company information, client details, itemized services or products, prices, and payment terms.

- Customize invoices: Tailor invoices to match brand identity with logos, color schemes, and personalized messages.

- Automate repetitive tasks: Automate recurring invoices, payment reminders, and other tasks to save time and reduce manual data entry.

- Track payments: Monitor the status of invoices, track payments received, and identify overdue invoices.

Benefits of Using Invoice Generators

Switching from manual invoicing to using an invoice generator offers several key benefits. These advantages contribute to improved efficiency, reduced errors, and a more professional image for businesses. Some of the advantages include:

- Time Savings: Automating invoice creation, sending, and tracking saves considerable time compared to manual methods.

- Reduced Errors: Automated calculations and data entry reduce the risk of human errors, leading to more accurate invoices.

- Professionalism: Invoice generators produce professional-looking invoices that enhance a company’s image.

- Improved Cash Flow: Faster invoice generation and payment reminders can accelerate the payment cycle and improve cash flow.

- Better Organization: Centralized invoice management makes it easier to track invoices, payments, and financial data.

- Cost Reduction: Reducing time spent on invoicing frees up resources, leading to lower operational costs.

Common Features of Invoice Generators

Invoice generators come equipped with a range of features designed to simplify and streamline the invoicing process. These features contribute to the efficiency, accuracy, and professionalism of the billing workflow.

- Invoice Templates: Provide pre-designed templates that can be customized to suit different business needs and branding.

- Customization Options: Allow users to add logos, change color schemes, and personalize messages to match their brand identity.

- Automated Calculations: Automatically calculate totals, taxes, and discounts to reduce the risk of errors.

- Recurring Invoices: Enable the scheduling and automatic sending of recurring invoices for regular services or subscriptions.

- Payment Reminders: Send automated reminders to clients when invoices are due or overdue.

- Payment Tracking: Track the status of invoices, record payments received, and identify overdue invoices.

- Reporting and Analytics: Generate reports on sales, revenue, and outstanding invoices to help monitor financial performance.

- Client Management: Store client information, including contact details and payment history, for easy access.

- Integration with Other Software: Integrate with accounting software, payment gateways, and other business tools to streamline the workflow.

For example, a small business owner, using an invoice generator, might save several hours each month that were previously spent manually creating and sending invoices. This time savings allows them to focus on other important aspects of their business, such as sales and customer service.

Core Components of an Invoice Generator

An invoice generator is a powerful tool for businesses of all sizes, streamlining the billing process and ensuring professional communication with clients. It simplifies the creation, management, and tracking of invoices, saving time and reducing the risk of errors. Understanding the core components is essential for building an effective and user-friendly invoice generator.

Essential Elements of an Invoice

Creating an effective invoice requires specific elements to ensure clarity and facilitate payment. These elements are critical for conveying the necessary information to the client and for legal and accounting purposes. Missing any of these could lead to confusion, payment delays, or even legal issues.The following table Artikels the essential data fields typically included in an invoice, along with their data types, examples, and descriptions.

| Field Name | Data Type | Example | Description |

|---|---|---|---|

| Invoice Number | Text (e.g., alphanumeric) | INV-2024-001 | A unique identifier for the invoice, essential for tracking and organization. Should be sequential or based on a defined system. |

| Invoice Date | Date | 2024-10-27 | The date the invoice was issued. Important for payment terms and tracking. |

| Due Date | Date | 2024-11-26 | The date by which the payment is expected. Calculated based on payment terms. |

| Bill To | Text (e.g., address) | Acme Corporation, 123 Main St, Anytown, USA | The client’s name and address to which the invoice is addressed. |

| Ship To (Optional) | Text (e.g., address) | Acme Corporation, Shipping Dept, 456 Oak Ave, Anytown, USA | The address where goods were shipped or services were provided, if different from the billing address. |

| Description of Goods/Services | Text | Website Design Services | A detailed description of the products or services provided. Critical for clarity and dispute resolution. |

| Quantity | Number (Integer or Decimal) | 1 | The number of units of a product or service provided. |

| Unit Price | Currency (e.g., USD, EUR) | $1,000.00 | The price per unit of the product or service. |

| Discount (Optional) | Currency or Percentage | $100.00 or 10% | Any discounts applied to the invoice. |

| Tax Rate | Percentage | 10% | The tax rate applied to the subtotal. |

| Tax Amount | Currency | $100.00 | The calculated tax amount based on the subtotal and tax rate. |

| Subtotal | Currency | $1,000.00 | The total cost of goods or services before taxes and discounts. |

| Total Amount Due | Currency | $1,100.00 | The final amount the client owes, including taxes and after discounts. |

| Payment Terms | Text | Net 30 | The conditions under which payment is expected (e.g., Net 30, Net 15, due upon receipt). |

| Notes (Optional) | Text | Thank you for your business! | Additional information, such as thank you notes, late payment fees, or special instructions. |

| Company Information | Text (e.g., address) | Your Company Name, 789 Pine Ln, Anytown, USA | The company’s name, address, and contact information. |

Payment Methods Supported by Invoice Generators

Offering a variety of payment methods increases the likelihood of prompt payment and provides convenience for clients. Invoice generators typically support several payment options to accommodate different preferences and geographical locations.Common payment methods include:

- Bank Transfer: Allows clients to pay directly from their bank accounts. Often includes providing the company’s bank account details, such as the account number and SWIFT/BIC code.

- Credit Card: Facilitates payments using major credit card brands like Visa, Mastercard, and American Express. This requires integration with a payment gateway.

- Debit Card: Similar to credit cards, enabling payments through debit cards, usually processed via a payment gateway.

- PayPal: Provides a widely recognized and secure online payment platform. This simplifies international transactions and offers buyer protection.

- Digital Wallets (e.g., Apple Pay, Google Pay): Enables contactless payments through mobile devices. Offers speed and convenience for clients.

- Check: Allows clients to pay via mailed checks, though this is becoming less common. Requires the company’s mailing address.

- Cash (Less Common): While less common for invoice generators, some might allow for recording cash payments. Suitable for local businesses with direct customer interaction.

Technologies and Platforms for Invoice Generation

The choice of technology and platform significantly impacts the functionality, scalability, and user experience of an invoice generator. Selecting the right tools and environment is crucial for building an efficient and reliable system. Understanding the strengths and weaknesses of various options allows developers to create a solution that meets specific business needs.

Programming Languages for Invoice Generation

Several programming languages are commonly employed in the development of invoice generators, each offering different advantages and trade-offs. The selection depends on factors such as desired features, performance requirements, and the development team’s expertise.

- Python: Python is a versatile language, known for its readability and extensive libraries. Its frameworks like Django and Flask simplify web application development, making it a popular choice for building web-based invoice generators. Libraries like ReportLab facilitate PDF generation, which is a critical function for invoices. Python’s large community and abundant resources also contribute to its popularity.

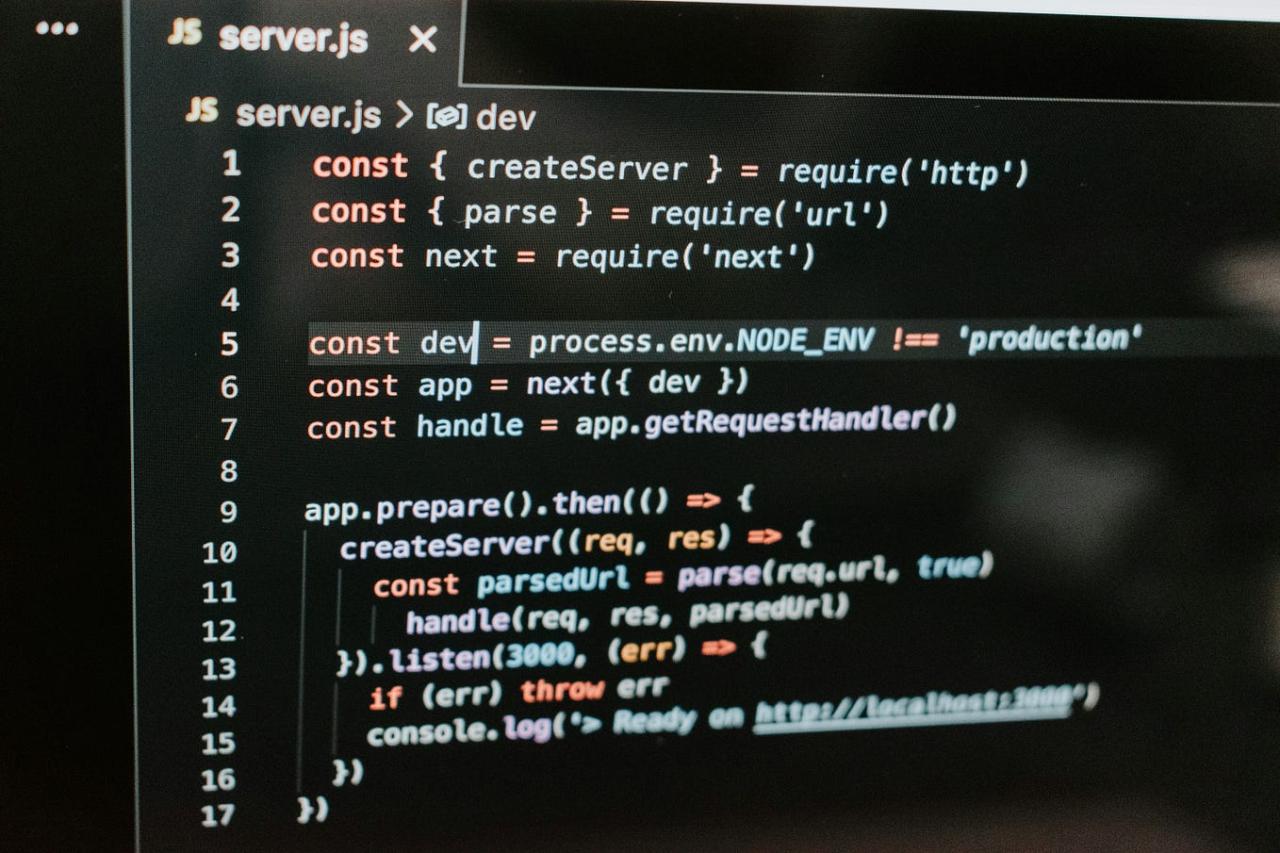

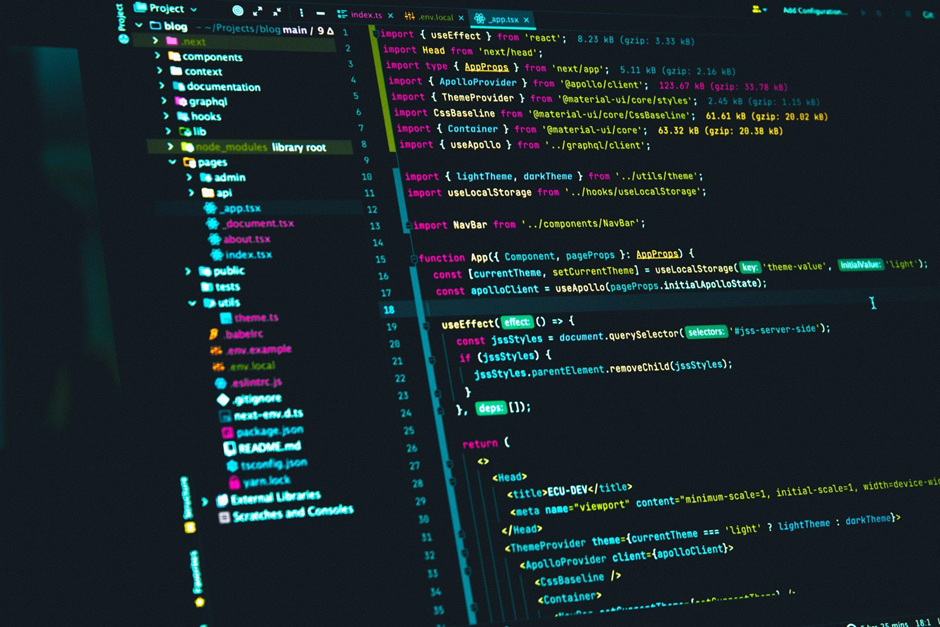

- JavaScript (with Node.js): JavaScript, particularly with Node.js, is another widely used option, especially for creating both front-end and back-end components. This allows developers to use a single language throughout the entire development process. Node.js provides a robust environment for server-side logic, while frameworks like React or Angular can be used for creating interactive user interfaces. Libraries such as jsPDF are useful for generating PDFs.

- PHP: PHP remains a relevant choice, particularly for integration with existing web servers and databases. It’s a mature language with a vast ecosystem of frameworks (like Laravel) and readily available resources. PHP’s ability to handle server-side tasks makes it suitable for building dynamic invoice generation systems.

- Java: Java is a robust and scalable language, well-suited for enterprise-level invoice generators. Frameworks like Spring Boot facilitate the development of complex applications. Java’s platform independence allows the same code to run on various operating systems. Libraries such as iText are used for creating and manipulating PDF documents.

- C#: C# (with .NET) is a strong choice, especially for Windows-based desktop applications or web applications. It offers a powerful development environment and benefits from the .NET ecosystem. Libraries such as PDFSharp are commonly used for PDF generation.

Platforms for Invoice Generation

The platform selected for an invoice generator significantly influences its accessibility, deployment, and maintenance. The primary choices include web-based applications and desktop applications.

- Web-Based Applications: Web-based invoice generators are accessible through a web browser, offering cross-platform compatibility. Users can access them from any device with an internet connection. This eliminates the need for software installation and simplifies updates. Web-based applications typically utilize a client-server architecture, where the user interface (front-end) runs in the browser, and the business logic and data storage (back-end) reside on a server.

- Desktop Applications: Desktop applications are installed and run directly on a user’s computer. They often offer greater performance and offline access compared to web-based applications. Desktop applications have direct access to system resources, potentially leading to faster processing. However, they are platform-specific (e.g., Windows, macOS) and require individual installations and updates on each device.

Advantages and Disadvantages of Cloud-Based Invoice Generators

Cloud-based invoice generators have become increasingly popular due to their flexibility and accessibility. These applications are hosted on remote servers and accessed over the internet.

Cloud-based invoice generators offer several advantages, including accessibility from any device with an internet connection, automatic updates, and reduced IT infrastructure costs. However, they also have disadvantages, such as reliance on internet connectivity and potential security concerns regarding data storage on third-party servers. Furthermore, vendor lock-in can be a concern, as migrating data to a different platform can be challenging.

Step-by-Step Guide: Building a Simple Invoice Generator

This section provides a practical, step-by-step guide to creating a basic invoice generator. It breaks down the process into manageable stages, covering the core elements from design to database integration. The goal is to offer a clear understanding of the development process, empowering you to build your own invoice generation tool.

General Steps in Invoice Generator Creation

The creation of an invoice generator involves several key stages, each contributing to the functionality and usability of the final product. Understanding these steps is crucial for planning and executing the development process effectively.

- Planning and Requirements Gathering: Define the features, target audience, and specific requirements of the invoice generator. This includes determining the necessary fields (e.g., client details, item descriptions, quantities, prices, taxes), the desired output format (e.g., PDF, HTML), and the overall user experience.

- User Interface (UI) Design: Design the layout and appearance of the invoice generator. This involves creating a user-friendly interface for data entry, invoice preview, and output generation. Consider the placement of elements, color schemes, and overall visual appeal to enhance usability.

- Backend Development: Develop the core logic and functionality of the invoice generator. This includes handling data input, calculations (e.g., subtotal, tax, total), and generating the invoice output. Choose a programming language and framework that suits your needs and technical expertise.

- Database Integration (Optional): Implement a database to store invoice information, client details, and other relevant data. This enables efficient data management, reporting, and historical tracking of invoices. Select a suitable database system (e.g., MySQL, PostgreSQL, SQLite) based on the project’s scale and requirements.

- Testing and Debugging: Thoroughly test the invoice generator to identify and fix any bugs or errors. This involves testing various scenarios, input validation, and ensuring the correct output generation.

- Deployment and Maintenance: Deploy the invoice generator to a suitable platform (e.g., web server, desktop application). Provide ongoing maintenance and updates to address any issues, incorporate new features, and ensure compatibility with evolving technologies.

Designing the User Interface of an Invoice Generator

A well-designed user interface (UI) is critical for a positive user experience. The UI should be intuitive, easy to navigate, and visually appealing. This section focuses on key aspects of designing an effective UI for your invoice generator.

Consider these elements when designing your UI:

- Layout and Structure: Organize the interface logically, grouping related elements together. Use clear headings, labels, and spacing to guide users through the process. A typical layout might include sections for client information, item details, and invoice summary.

- Data Entry Fields: Provide clearly labeled input fields for all necessary information, such as client name, address, invoice number, date, item descriptions, quantities, and prices. Use appropriate input types (e.g., text boxes, dropdown menus, date pickers) to facilitate data entry.

- Preview and Editing: Include a preview section that displays the invoice as it will appear in the final output. Allow users to edit and modify information before generating the invoice. This helps ensure accuracy and reduces errors.

- Buttons and Actions: Use clear and concise button labels for actions like “Save,” “Generate Invoice,” “Preview,” and “Clear.” Provide visual cues (e.g., color changes, hover effects) to indicate the active state of buttons.

- Responsiveness: Ensure the UI is responsive and adapts to different screen sizes and devices. This ensures a consistent user experience across various platforms.

- Visual Appeal: Choose a clean and professional design with a consistent color scheme, fonts, and branding elements. Avoid clutter and ensure the interface is visually pleasing.

Example of UI design elements:

Imagine a simple UI with the following structure:

Client Information Section:

- Client Name: [Text Field]

- Client Address: [Text Area]

- Invoice Date: [Date Picker]

- Invoice Number: [Text Field]

Item Details Section:

- Item Description: [Text Area]

- Quantity: [Number Field]

- Unit Price: [Number Field]

- Add Item Button: [Button]

Invoice Summary Section:

- Subtotal: [Display Field]

- Tax: [Display Field]

- Total: [Display Field]

Action Buttons:

- Preview Invoice: [Button]

- Generate Invoice: [Button]

Integrating a Basic Database for Storing Invoice Information

Integrating a database enhances the invoice generator by enabling data persistence, reporting, and efficient data management. This section Artikels the steps involved in integrating a basic database.

Here’s how to integrate a basic database:

- Choose a Database System: Select a database system that suits your needs. For simple invoice generators, SQLite is a good choice due to its ease of use and file-based storage. For more complex applications, consider MySQL, PostgreSQL, or other relational database management systems (RDBMS).

- Design the Database Schema: Define the structure of your database, including tables and fields. Consider these tables:

- Invoices Table: Stores general invoice information (e.g., invoice number, date, client ID, total amount).

- Clients Table: Stores client details (e.g., client name, address, contact information).

- Invoice Items Table: Stores item details for each invoice (e.g., invoice ID, item description, quantity, price).

- Create the Database and Tables: Use SQL (Structured Query Language) to create the database and tables. For example, using SQL, the “Clients” table could be created like this:

CREATE TABLE Clients ( ClientID INT PRIMARY KEY, ClientName VARCHAR(255), ClientAddress TEXT, ContactNumber VARCHAR(20) ); - Connect to the Database: Establish a connection to the database from your invoice generator application. This typically involves providing database credentials (e.g., host, username, password) and using a database connector library (e.g., PHP’s PDO, Python’s sqlite3).

- Implement Data Operations (CRUD): Implement the basic CRUD (Create, Read, Update, Delete) operations to interact with the database:

- Create: Insert new data into the database (e.g., adding a new client or invoice).

- Read: Retrieve data from the database (e.g., fetching client details for an invoice).

- Update: Modify existing data in the database (e.g., updating a client’s address).

- Delete: Remove data from the database (e.g., deleting an invoice).

- Store and Retrieve Invoice Data: When an invoice is generated, store the relevant data in the database. When displaying or editing an invoice, retrieve the data from the database.

- Error Handling: Implement proper error handling to manage database connection issues, invalid data, and other potential problems.

Advanced Features and Functionality

Incorporating advanced features significantly elevates an invoice generator, transforming it from a basic tool to a comprehensive business solution. These features enhance usability, professionalism, and overall efficiency in managing financial transactions. Let’s delve into some key advanced functionalities.

Incorporating Tax Calculations

Tax calculations are essential for generating accurate invoices, especially for businesses operating in regions with complex tax regulations. Properly implemented tax calculations ensure compliance and provide clarity for both the business and the client.To incorporate tax calculations, the invoice generator needs to:

- Allow Tax Rate Configuration: Provide a mechanism to define and store tax rates. This could involve setting a default tax rate, as well as allowing the user to specify different tax rates for various items or services.

- Calculate Tax Automatically: The system should automatically calculate the tax amount based on the item price, quantity, and applicable tax rate. This requires a formula such as:

Tax Amount = (Item Price

– Quantity)

– Tax Rate - Support Multiple Tax Rates: The invoice generator should accommodate scenarios where multiple tax rates apply to different items on the same invoice. For example, some items might be subject to VAT, while others are exempt.

- Display Tax Information Clearly: The invoice should clearly display the tax rate, the tax amount for each item, and the total tax amount. This information is crucial for transparency and accurate accounting.

- Handle Tax Exemptions: The system should allow users to mark certain items or clients as tax-exempt.

- Consider Regional Tax Variations: The generator should be adaptable to different tax systems, which may involve sales tax, VAT, GST, or other forms of taxation.

For example, consider a scenario where a company in the United States sells a product for $100, and the sales tax rate is 6%. The invoice generator would calculate the tax amount as $6 (1000.06), and the total amount due would be $106. If the same company sold a service in Europe, the generator should handle VAT.

Generating Professional-Looking Invoice Templates

Professional invoice templates enhance a business’s credibility and make it easier for clients to understand and process invoices. A well-designed template includes branding elements, clear formatting, and essential information.Key aspects of creating professional invoice templates include:

- Branding: Incorporate the business’s logo, colors, and fonts to create a consistent brand identity. This builds recognition and professionalism.

- Clear Formatting: Use a clean and organized layout with clear headings, sections, and spacing. This ensures that the information is easy to read and understand.

- Essential Information: Include all necessary details, such as the business name, address, contact information, invoice number, invoice date, due date, client information, a detailed list of items or services provided, prices, taxes, and the total amount due.

- Professional Design: Use a visually appealing design that is consistent with the brand. Avoid cluttered layouts or excessive use of colors and fonts.

- Customization Options: Allow users to customize the template with different layouts, fonts, and colors. This ensures that the invoice generator can accommodate various branding preferences.

- Templates for Different Scenarios: Consider providing different templates for various situations, such as service invoices, product invoices, and pro forma invoices.

- Preview Functionality: Include a preview function so users can see how the invoice will look before it is generated.

A good invoice template might resemble a simple table with the company logo at the top, followed by the invoice number and date. The main section would list items with descriptions, quantities, and prices, with subtotals, taxes, and the final total clearly displayed at the bottom.

Features to Add to the Invoice Generator

To enhance the functionality and usability of the invoice generator, several features can be added. These features cater to various business needs and improve overall efficiency.Here is a list of features to consider:

- Recurring Invoices: Automate the generation of invoices for recurring services or subscriptions.

- Payment Tracking: Allow users to record payments received, track outstanding balances, and send payment reminders.

- Reporting and Analytics: Provide reports on sales, revenue, and outstanding invoices.

- Customer Management: Integrate a customer database to store client information, making it easier to manage contacts and addresses.

- Multiple Currency Support: Allow users to generate invoices in different currencies, catering to international clients.

- Integration with Payment Gateways: Enable clients to pay invoices online through integrations with payment gateways like PayPal or Stripe.

- Customizable Email Templates: Provide options to customize email templates for sending invoices and payment reminders.

- Mobile Accessibility: Make the invoice generator accessible on mobile devices, allowing users to create and manage invoices on the go.

- Inventory Management: Integrate with inventory management systems to automatically update stock levels when items are invoiced.

- User Roles and Permissions: Implement user roles and permissions to control access to sensitive data and features.

- Support for Discounts and Promotions: Allow users to apply discounts and promotional codes to invoices.

- Advanced Reporting: Offer detailed reporting, including profit and loss statements, sales tax summaries, and customer payment histories.

- Bulk Invoice Generation: Enable users to generate multiple invoices simultaneously.

Database Integration and Data Management

Integrating a database into your invoice generator is crucial for efficient data storage, retrieval, and management. It transforms your application from a simple tool to a robust system capable of handling large volumes of data, ensuring data integrity, and providing valuable insights. Proper database integration allows for automation, scalability, and enhanced security, making your invoice generator a reliable and professional solution.

Importance of Database Integration

Database integration offers several advantages for invoice generators, significantly enhancing their functionality and reliability.

- Data Persistence: A database provides a persistent storage solution, ensuring that invoice data is saved and readily accessible even after the application is closed. This eliminates the risk of data loss and allows for easy retrieval of past invoices.

- Data Organization: Databases offer structured data organization, allowing for efficient storage and retrieval of information. This includes features like indexing and relationships between different data elements (e.g., linking customers to invoices).

- Scalability: As your business grows and the number of invoices increases, a database can easily scale to accommodate the expanding data volume. This ensures that the application remains performant and responsive.

- Data Integrity: Databases enforce data integrity rules, such as data type validation and constraints, to ensure the accuracy and consistency of the data. This minimizes errors and inconsistencies in your invoices.

- Reporting and Analysis: Databases facilitate reporting and analysis by providing tools for querying and summarizing data. This allows you to generate reports on sales, revenue, and other key performance indicators (KPIs).

- Automation: Database integration enables automation of various tasks, such as invoice generation, payment tracking, and sending reminders.

- Security: Databases offer security features, such as user authentication and access control, to protect sensitive invoice data from unauthorized access.

Setting Up a Database

Setting up a database involves several steps, from choosing the right database system to defining the data structure and establishing connections. The specific steps will vary depending on the chosen database system (e.g., MySQL, PostgreSQL, MongoDB), but the general process remains consistent.

Here’s a step-by-step guide:

- Choose a Database System: Select a database system based on your needs. Relational database management systems (RDBMS) like MySQL or PostgreSQL are suitable for structured data, while NoSQL databases like MongoDB may be better for handling unstructured or semi-structured data. Consider factors like scalability, performance, and ease of use.

- Install and Configure the Database: Install the chosen database system on your server or local machine. Configure the database server with appropriate settings, such as port numbers and user access permissions.

- Create a Database: Create a new database specifically for your invoice generator. This database will serve as the container for all your invoice-related data.

- Define Tables and Data Structure: Design the database schema, which defines the tables and the relationships between them. Key tables include:

- Customers: Stores customer information (e.g., name, address, contact details).

- Invoices: Stores invoice details (e.g., invoice number, date, customer ID, total amount).

- Invoice Items: Stores individual items on each invoice (e.g., product description, quantity, price).

Define the columns (fields) for each table, specifying data types (e.g., text, number, date) and any constraints (e.g., primary keys, foreign keys).

- Establish Database Connections: Configure your invoice generator application to connect to the database. This involves providing the database server address, username, password, and database name. Use appropriate database drivers or libraries for your chosen programming language (e.g., PHP, Python, Java).

- Implement Data Operations: Write code to perform database operations, such as inserting, updating, deleting, and retrieving data. This includes creating functions to add new customers, generate invoices, update invoice statuses, and retrieve invoice details.

Example of a simple Customer table schema (MySQL):

This table illustrates a fundamental structure for storing customer data within a relational database.

CREATE TABLE Customers (

CustomerID INT PRIMARY KEY AUTO_INCREMENT,

CustomerName VARCHAR(255) NOT NULL,

Address VARCHAR(255),

City VARCHAR(100),

State VARCHAR(100),

ZipCode VARCHAR(20),

Email VARCHAR(255),

PhoneNumber VARCHAR(20)

);

Example of a simple Invoices table schema (MySQL):

This table illustrates a fundamental structure for storing invoice data within a relational database.

CREATE TABLE Invoices (

InvoiceID INT PRIMARY KEY AUTO_INCREMENT,

CustomerID INT,

InvoiceNumber VARCHAR(50) NOT NULL,

InvoiceDate DATE,

DueDate DATE,

TotalAmount DECIMAL(10, 2),

Status VARCHAR(50), -- e.g., 'Draft', 'Sent', 'Paid'

FOREIGN KEY (CustomerID) REFERENCES Customers(CustomerID)

);

Example of a simple InvoiceItems table schema (MySQL):

This table illustrates a fundamental structure for storing invoice items data within a relational database.

CREATE TABLE InvoiceItems (

InvoiceItemID INT PRIMARY KEY AUTO_INCREMENT,

InvoiceID INT,

Description TEXT,

Quantity INT,

UnitPrice DECIMAL(10, 2),

Amount DECIMAL(10, 2),

FOREIGN KEY (InvoiceID) REFERENCES Invoices(InvoiceID)

);

Backing Up and Securing Invoice Data

Protecting your invoice data is paramount to prevent data loss and maintain data integrity.

Implementing robust backup and security measures is essential.

- Regular Backups: Implement a regular backup strategy to create copies of your database. Backups should be performed frequently (e.g., daily, weekly) depending on the volume and criticality of your data. Store backups in a secure, off-site location to protect against data loss due to hardware failures, natural disasters, or other unforeseen events.

- Backup Methods:

- Full Backups: Copy the entire database.

- Incremental Backups: Copy only the changes made since the last backup.

- Differential Backups: Copy the changes made since the last full backup.

- Encryption: Encrypt sensitive data, such as customer information and financial details, both at rest (stored in the database) and in transit (during data transfer). Use strong encryption algorithms (e.g., AES-256) and secure key management practices.

- Access Control: Implement robust access control mechanisms to restrict access to the database and sensitive data. Use user authentication (passwords, multi-factor authentication) and authorization (role-based access control) to ensure that only authorized personnel can access and modify data.

- Security Audits: Conduct regular security audits to identify and address potential vulnerabilities in your database and application. This includes reviewing database configurations, application code, and security protocols.

- Database Firewall: Consider using a database firewall to monitor and filter database traffic, preventing unauthorized access and malicious attacks.

- Data Retention Policies: Define and implement data retention policies to determine how long invoice data should be stored. This helps to comply with legal and regulatory requirements and to manage storage space.

- Disaster Recovery Plan: Develop a disaster recovery plan to Artikel the steps to be taken in the event of a data loss or system failure. This plan should include procedures for restoring data from backups and recovering the system.

Example of Backup Strategy:

Consider a daily full backup, weekly incremental backups, and monthly differential backups to maintain a robust data protection strategy. Backups should be automated and stored securely off-site.

Example of Encryption in Transit (using SSL/TLS):

When connecting to the database server from your application, ensure that the connection is encrypted using SSL/TLS to protect data in transit. Most database systems support SSL/TLS connections. For example, in MySQL, you can configure SSL/TLS by setting up certificates and enabling the require_secure_transport option.

User Interface (UI) and User Experience (UX) Design

Designing a user-friendly interface is paramount for the success of any invoice generator. A well-designed UI/UX not only streamlines the process of creating invoices but also enhances user satisfaction and reduces the likelihood of errors. This section will delve into the principles of designing an intuitive UI and creating a positive user experience for your invoice generator.

Principles of Intuitive UI Design

Creating an intuitive user interface involves adhering to several key principles. These principles guide the design process and ensure that the interface is easy to learn, use, and understand.

- Clarity: The interface should be clear and unambiguous. Users should immediately understand the purpose of each element and how to interact with it. This involves using clear labels, concise instructions, and a logical visual hierarchy.

- Consistency: Maintain consistency in design elements, such as button styles, color schemes, and navigation patterns. Consistency reduces cognitive load and allows users to quickly learn the interface. For example, if the “Save” button is always green, users will quickly associate green with saving actions.

- Efficiency: Design the interface to minimize the number of steps required to complete a task. This can be achieved through features like keyboard shortcuts, pre-filled fields, and intuitive workflows.

- Feedback: Provide immediate and informative feedback to user actions. This can include visual cues, such as button highlights or progress indicators, and error messages that clearly explain what went wrong and how to fix it.

- Control: Give users control over the interface. Allow them to undo actions, customize settings, and easily navigate between different sections of the application.

- Accessibility: Design the interface to be accessible to users with disabilities. This includes providing alternative text for images, ensuring sufficient color contrast, and supporting keyboard navigation.

Guidelines for User-Friendly Experience

A user-friendly experience goes beyond just a well-designed interface; it encompasses the overall interaction a user has with the invoice generator.

- Understand Your Users: Before designing, understand your target audience. Consider their technical skills, needs, and preferences. Design the interface to cater to their specific requirements. For instance, a small business owner might need a simpler interface than a large corporation with complex invoicing needs.

- Prioritize Information: Organize information logically and prioritize the most important elements. Use visual hierarchy to guide users’ attention and highlight key information. The invoice total, for example, should be prominently displayed.

- Use White Space Effectively: White space, or negative space, is crucial for readability and visual clarity. Use white space to separate elements, group related information, and create a clean and uncluttered layout.

- Provide Contextual Help: Offer helpful information and guidance at every step. Tooltips, inline help text, and tutorials can assist users in understanding the interface and completing tasks.

- Test and Iterate: Regularly test the interface with real users and gather feedback. Use this feedback to iterate on the design and make improvements. A/B testing different design options can help identify the most user-friendly approach.

- Mobile Responsiveness: Ensure the invoice generator is responsive and works seamlessly on different devices, including desktops, tablets, and smartphones. This allows users to create and manage invoices on the go.

Detailed Description of a Modern Invoice Generator Interface

A clean and modern invoice generator interface should prioritize simplicity, clarity, and ease of use. The following is a detailed description of such an interface:

The interface opens with a clear and concise dashboard, providing an overview of recent invoices, outstanding payments, and key performance indicators (KPIs). The top navigation bar features the company logo, a user profile icon, and a search bar. A primary action button, labeled “Create Invoice” (often in a contrasting color, such as a vibrant blue or green), is prominently displayed, drawing immediate attention.

The main content area is divided into several key sections:

- Invoice Creation Form: This is the central component. It’s structured into logical sections for entering invoice details.

- Customer Information: Fields for customer name, address, contact information, and a dropdown menu to select from existing customers (with auto-complete functionality for quick selection).

- Invoice Details: A section for invoice number (auto-generated or customizable), invoice date, due date, and a field to add a purchase order number (if applicable).

- Line Items: A table to add individual line items. Each row includes fields for a description, quantity, unit price, and a calculated total. There’s a clear “Add Item” button to add new rows.

- Subtotal, Tax, and Total: These are displayed prominently at the bottom of the line items section, with clear labels and dynamically updating calculations as line items are added or modified.

- Notes and Terms: Fields to add notes for the customer and invoice terms.

- Payment Information: This section includes options for selecting payment methods, such as credit card, bank transfer, or PayPal.

- Preview and Actions: A “Preview” button allows users to see a rendered version of the invoice before sending. Actions include “Save Draft,” “Send Invoice,” and “Download PDF” (or similar export options).

Layout and Key Interactive Elements:

- Layout: The layout is generally two-column or three-column. The left column often contains a navigation menu for accessing different sections of the application (e.g., Dashboard, Customers, Invoices, Reports, Settings). The right column (or the main content area) houses the invoice creation form and other relevant information.

- Color Scheme: A modern color palette is used, often with a light background and a primary color for key elements (e.g., buttons, highlights). The color scheme is consistent throughout the interface.

- Typography: A clean, readable font is used for all text, with clear headings and subheadings to organize information.

- Buttons: Buttons are clearly labeled and visually distinct, with hover effects to indicate interactivity.

- Input Fields: Input fields are well-defined, with clear labels and appropriate validation. Tooltips or inline help text are provided to guide users.

- Tables: Tables are used to display line items and other data. They are designed to be easily scannable and sortable.

- Progress Indicators: Progress indicators (e.g., loading spinners) are used to provide feedback during long-running operations, such as saving or sending invoices.

- Responsive Design: The interface is fully responsive and adapts to different screen sizes, ensuring a consistent experience on all devices.

Illustration:

Imagine a clean and modern interface. The background is a soft, off-white color. A prominent logo is placed in the top-left corner. The top navigation bar is a darker shade of the primary color, with a search bar on the right and the user profile icon. The “Create Invoice” button is a bright blue and placed prominently on the right side of the top navigation bar.

The main content area is divided into logical sections. Customer information is on top, with clear labels and input fields. Below is the line items table, with clearly defined columns for description, quantity, unit price, and total. An “Add Item” button is located at the bottom of the table. The subtotal, tax, and total are displayed prominently below the line items table.

The right side of the screen displays the invoice preview, updating in real-time as changes are made. At the bottom, the “Save Draft,” “Send Invoice,” and “Download PDF” buttons are easily accessible. The overall look is clean, uncluttered, and intuitive, guiding the user through the invoice creation process seamlessly.

Customization and Branding Options

Customization and branding are crucial for invoice generators. They allow businesses to create professional invoices that reflect their unique identity and build brand recognition. Providing users with the ability to tailor the appearance of their invoices, along with options to incorporate their branding elements, enhances the overall user experience and strengthens brand consistency.

Customizing Invoice Appearance

Allowing users to customize the appearance of their invoices significantly improves the professional look and feel of the documents. This can be achieved through a variety of options.

- Theme Selection: Offer pre-designed invoice themes or templates. This allows users to quickly choose a style that aligns with their brand aesthetic. Consider offering a range of themes, from minimalist to more elaborate designs, to cater to diverse preferences. For example, a user could select a theme with a modern, clean layout for a tech startup, or a more traditional design for a law firm.

- Color Customization: Provide color palette options. Users should be able to modify the primary and secondary colors used in the invoice, such as the header background, text color, and accent colors. This allows them to match the invoice colors to their brand guidelines.

- Font Selection: Enable font customization. Allow users to choose different fonts for the invoice header, body text, and other elements. Ensure a variety of font styles are available, including sans-serif and serif fonts, to suit different branding needs.

- Layout Options: Offer different layout options for invoice elements. For example, allow users to adjust the placement of the logo, address, and invoice details. This flexibility enables users to create invoices that best fit their specific requirements.

Incorporating Branding Elements

Incorporating branding elements into an invoice generator allows businesses to reinforce their brand identity and create a cohesive brand experience.

- Logo Integration: Allow users to upload their company logo. This is a fundamental branding element that should be prominently displayed on the invoice. The system should provide options for logo placement (e.g., top left, top right, centered) and size adjustments.

- Company Name and Contact Information: Automatically include the company name, address, phone number, email, and website on the invoice. Ensure this information is easily editable and customizable.

- Custom Headers and Footers: Provide options for custom headers and footers. Users can use these sections to include their company slogan, legal disclaimers, or other relevant information.

- Social Media Links: Consider adding social media links to the invoice. This is a modern branding element that helps businesses connect with their customers on different platforms.

Adding a Logo to Invoices

The ability to add a logo is a core feature for any invoice generator. The process should be user-friendly and intuitive.

- Upload Functionality: Implement a simple and secure logo upload feature. Users should be able to upload images in common formats like JPG, PNG, and SVG.

- Image Resizing and Cropping: Provide options for resizing and cropping the logo. This allows users to ensure the logo fits appropriately within the invoice design.

- Placement Options: Offer various placement options for the logo. Common options include top left, top right, and centered. The user should be able to preview the logo placement before saving the invoice.

- Preview Functionality: Implement a real-time preview of the invoice with the logo. This allows users to visualize how the logo will appear on the final document and make necessary adjustments.

Testing and Debugging

Testing and debugging are critical phases in the development of an invoice generator. Rigorous testing ensures the application functions correctly, meets user requirements, and produces accurate invoices. Debugging is the process of identifying and resolving errors that arise during development, leading to a stable and reliable final product. Thorough testing and effective debugging practices are essential for delivering a high-quality invoice generator.

Importance of Testing an Invoice Generator

Testing is crucial to guarantee the reliability, accuracy, and usability of an invoice generator. Without adequate testing, the application might produce incorrect calculations, formatting errors, or security vulnerabilities. These issues can lead to significant problems for users, including financial losses, legal complications, and damage to their business reputation.

Common Issues During Development

During the development of an invoice generator, various issues can arise. Addressing these issues efficiently through testing and debugging is essential for a successful project.

- Calculation Errors: Incorrect formulas or data processing can lead to inaccurate invoice totals, taxes, or discounts. For example, a bug in a discount calculation might apply the discount incorrectly, leading to discrepancies between the invoice and the actual amount due.

- Formatting Issues: Inconsistencies in the invoice layout, such as misaligned text, incorrect font sizes, or poorly formatted dates and numbers, can make invoices difficult to read and unprofessional.

- Data Input Validation Errors: The system might not properly validate user inputs, allowing incorrect or incomplete data to be entered, leading to errors in the invoice.

- Database Integration Problems: Issues with database connections, data storage, or data retrieval can cause the invoice generator to fail to save or retrieve invoice data correctly.

- User Interface (UI) Bugs: UI elements might not function as expected, causing usability problems, such as unresponsive buttons, incorrect display of data, or confusing navigation.

- Security Vulnerabilities: The invoice generator might be susceptible to security threats, such as SQL injection or cross-site scripting (XSS) attacks, that could compromise user data.

- Performance Issues: The application might run slowly or become unresponsive, especially when handling large datasets or complex calculations, causing a poor user experience.

- Compatibility Issues: The invoice generator might not function correctly on different operating systems, web browsers, or devices.

- Printing and Exporting Errors: The generated invoices might not print or export correctly to different formats, such as PDF, leading to difficulties in sharing and archiving invoices.

Debugging Process

The debugging process involves identifying, analyzing, and fixing errors within the invoice generator. This process typically involves several steps.

- Error Identification: The first step is to identify the presence of an error. This can be done through testing, user reports, or by examining the application’s logs. The logs provide valuable information about what the application was doing at the time of the error.

- Error Reproduction: Once an error is identified, it is important to reproduce it. This involves determining the specific steps or conditions that cause the error to occur consistently. Reproducing the error allows developers to understand the root cause and test potential solutions.

- Error Isolation: The next step is to isolate the error to a specific section of the code. This involves using debugging tools, such as debuggers and print statements, to trace the execution flow and identify the problematic lines of code.

- Root Cause Analysis: After isolating the error, the root cause must be determined. This involves analyzing the code, data, and any external dependencies to understand why the error is occurring.

- Error Correction: Once the root cause is understood, the error can be corrected by modifying the code. This may involve fixing bugs, rewriting sections of code, or adding new functionality.

- Testing: After the error has been corrected, the application must be tested to ensure the fix works and doesn’t introduce new errors. This includes retesting the specific error and testing other related areas of the application.

- Documentation: The debugging process should be documented. This includes the error, the steps to reproduce it, the root cause, the fix, and any testing results. This documentation helps to prevent the error from recurring and aids in future maintenance.

Deployment and Maintenance

Deploying and maintaining an invoice generator is crucial for its accessibility and long-term functionality. Proper deployment ensures users can access the application, while ongoing maintenance keeps it running smoothly, secure, and up-to-date. This section Artikels the steps involved in deploying an invoice generator and the necessary maintenance tasks to ensure its optimal performance.

Deployment Steps

Deploying an invoice generator involves making it accessible to users, typically through a web server or a dedicated application platform. The specific steps vary depending on the chosen technology stack and deployment environment. However, the general process includes the following:

- Choose a Deployment Platform: The platform selection is influenced by the technology used for development. Popular choices include:

- Cloud Platforms: Services like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure offer scalable and reliable infrastructure.

- Web Servers: Apache, Nginx, or other web servers can host the application, especially for simpler deployments.

- Containerization: Docker allows for packaging the application and its dependencies into a container for consistent deployment across different environments.

- Prepare the Application: Ensure the application code is ready for deployment. This may involve:

- Building: Compile or package the code, especially for languages like Java or .NET.

- Configuration: Set up environment-specific configurations (database connection strings, API keys, etc.).

- Dependencies: Verify that all necessary libraries and dependencies are included.

- Set Up the Environment: Configure the chosen platform or server to host the application. This involves:

- Server Configuration: Setting up the web server, database server, and other necessary services.

- Domain and DNS: Configuring the domain name and DNS records to point to the server.

- Security: Implementing security measures like SSL/TLS certificates for secure communication.

- Deploy the Application: Upload the application files to the server and configure the deployment process. This might involve:

- File Transfer: Using FTP, SSH, or other file transfer methods to upload the application code.

- Container Deployment: Deploying Docker containers to the chosen platform.

- Configuration Management: Using tools like Ansible or Terraform to automate deployment and configuration.

- Test the Application: After deployment, thoroughly test the invoice generator to ensure it functions correctly. This includes:

- Functional Testing: Verifying that all features, such as invoice creation, editing, and sending, work as expected.

- Performance Testing: Assessing the application’s performance under load to ensure it can handle a large number of users.

- Security Testing: Checking for vulnerabilities and ensuring the application is secure against common threats.

Ongoing Maintenance Tasks

Maintaining an invoice generator is an ongoing process that ensures its reliability, security, and performance. Regular maintenance tasks include:

- Monitoring: Continuously monitor the application’s performance, server resources, and error logs. This involves:

- Server Monitoring: Tracking CPU usage, memory consumption, and disk space.

- Application Monitoring: Monitoring response times, error rates, and user activity.

- Alerting: Setting up alerts to notify administrators of critical issues.

- Security Updates: Regularly update the application’s dependencies and security patches to address vulnerabilities. This involves:

- Dependency Updates: Keeping all libraries and frameworks up-to-date.

- Security Patching: Applying security patches to the operating system, web server, and database server.

- Vulnerability Scanning: Regularly scanning the application for known vulnerabilities.

- Backup and Recovery: Implement a robust backup and recovery strategy to protect against data loss. This includes:

- Data Backups: Regularly backing up the database and application files.

- Backup Testing: Regularly testing the backup and recovery process to ensure it works correctly.

- Disaster Recovery Plan: Having a plan in place to restore the application in case of a major outage.

- Performance Optimization: Continuously optimize the application’s performance to ensure it runs efficiently. This involves:

- Code Optimization: Identifying and fixing performance bottlenecks in the code.

- Database Optimization: Optimizing database queries and indexing.

- Caching: Implementing caching mechanisms to reduce server load.

- User Support: Provide user support and address any issues or feedback. This includes:

- Help Desk: Providing a help desk or support system for users to report issues.

- Feedback Collection: Collecting user feedback to improve the application.

- Documentation: Maintaining up-to-date documentation for users.

Updating and Upgrading the Invoice Generator

Updating and upgrading the invoice generator ensures it benefits from the latest features, bug fixes, and security enhancements. The process involves several steps:

- Plan the Update: Before updating, plan the upgrade process, considering:

- Testing Environment: Test the update in a staging or development environment before deploying it to production.

- Backup: Create a backup of the current version.

- Compatibility: Check compatibility with the existing system and dependencies.

- Download the Update: Obtain the updated version of the invoice generator. This might involve:

- Downloading from Source: Downloading the latest version from the software vendor or repository.

- Package Manager: Using a package manager (e.g., npm, pip) to install the update.

- Install the Update: Install the update on the server. This may involve:

- Replacing Files: Replacing the existing application files with the updated ones.

- Running Installation Scripts: Running any necessary installation scripts to update the database or configure the application.

- Test the Updated Application: Thoroughly test the updated invoice generator to ensure everything works correctly. This includes:

- Functional Testing: Verify all features work as expected.

- Regression Testing: Ensure existing features still function correctly.

- Performance Testing: Check the performance of the updated application.

- Deploy to Production: Once the update has been successfully tested, deploy it to the production environment. This might involve:

- Cutover: Switching the application over to the new version.

- Monitoring: Monitoring the application after the update to identify any issues.

- Rollback Plan: Have a rollback plan in case the update causes issues. This involves:

- Restoring from Backup: Being prepared to restore the previous version if necessary.

- Troubleshooting: Having a plan to troubleshoot any issues that arise.

Conclusive Thoughts

In conclusion, learning “how to coding invoice generator” equips you with the knowledge to streamline your billing processes, enhance your brand image, and gain greater control over your financial operations. By following the steps Artikeld in this guide, you’ll be well-prepared to design, build, and maintain an invoice generator tailored to your specific requirements. Embrace the possibilities and take the first step towards efficient and professional invoicing.