Embark on a journey into the dynamic realm of crypto payment systems, where innovation meets finance. This guide delves into the intricacies of integrating cryptocurrency payments, providing a roadmap for developers, entrepreneurs, and enthusiasts eager to embrace the future of digital transactions. We’ll explore the core components, historical context, and the advantages that crypto payments offer to both businesses and consumers.

This comprehensive overview covers the essential aspects of building a crypto payment system, from understanding blockchain fundamentals and selecting the right payment gateway to implementing secure transactions and managing financial reporting. We’ll explore the various cryptocurrencies suitable for payments, the critical role of smart contracts, and the practical steps involved in integrating these systems into e-commerce platforms. Furthermore, this guide will delve into security best practices, compliance considerations, and the emerging trends shaping the future of crypto payments.

Introduction: Understanding Crypto Payment Systems

Crypto payment systems represent a paradigm shift in how we conduct financial transactions, offering an alternative to traditional banking and payment networks. They leverage the power of cryptography and blockchain technology to enable secure, transparent, and often borderless transfers of value. This introduction will explore the core concepts, historical context, and advantages of crypto payment systems.

Core Components of Crypto Payment Systems

Crypto payment systems rely on several fundamental components to function effectively. These elements work in concert to facilitate transactions, ensure security, and maintain the integrity of the system.

- Blockchain Technology: The backbone of most crypto payment systems, a blockchain is a distributed, immutable ledger that records all transactions in a chronological order. Each block of transactions is linked to the previous one, creating a chain, hence the name “blockchain.” This structure ensures that transactions are tamper-proof and transparent, as any alteration to a block would require altering all subsequent blocks, a computationally intensive process.

The immutability is achieved through cryptographic hashing.

- Cryptocurrencies: These are digital or virtual currencies that use cryptography for security. They are the medium of exchange within crypto payment systems. Examples include Bitcoin (BTC), Ethereum (ETH), and many altcoins (alternative cryptocurrencies). The value of a cryptocurrency is often determined by market forces (supply and demand), and its usability depends on its acceptance by merchants and users.

- Wallets: Crypto wallets are software or hardware tools that store and manage the private keys required to access and spend cryptocurrencies. There are various types of wallets, including software wallets (desktop, mobile, web-based) and hardware wallets (physical devices). The security of a wallet is paramount, as a lost or compromised private key can result in the loss of the associated cryptocurrency.

- Payment Gateways: These act as intermediaries between merchants and crypto payment systems. They allow merchants to accept cryptocurrencies as payment, converting the crypto into fiat currency (USD, EUR, etc.) or holding it as crypto, depending on the merchant’s preference. Payment gateways handle the technical complexities of processing crypto transactions, such as address generation, transaction verification, and currency conversion.

- Mining/Staking (for Proof-of-Work/Proof-of-Stake Blockchains): In some crypto systems, like Bitcoin, “miners” use computational power to solve complex mathematical problems to validate transactions and add new blocks to the blockchain. This process, called “mining,” secures the network and incentivizes participation. Other systems, like Ethereum (after The Merge), use “staking,” where users lock up their cryptocurrency to validate transactions and earn rewards.

Distinctions from Traditional Payment Methods

Crypto payment systems differ significantly from traditional payment methods, such as credit cards, bank transfers, and online payment processors like PayPal. These differences impact aspects such as transaction speed, fees, security, and privacy.

- Decentralization: Crypto payments are decentralized, meaning they are not controlled by a single entity, such as a bank or government. This decentralization reduces the risk of censorship and single points of failure. Traditional systems are centralized and rely on intermediaries.

- Transaction Fees: Crypto transactions often have lower fees than traditional methods, especially for international transfers. Fees are typically paid to miners or stakers for validating transactions. Traditional methods often involve fees charged by banks, payment processors, and other intermediaries.

- Transaction Speed: Crypto transaction speeds vary depending on the cryptocurrency and network congestion. Some cryptocurrencies offer near-instant transactions, while others can take minutes or even hours to confirm. Traditional bank transfers can take days to process, while credit card transactions are typically faster.

- Security: Crypto transactions are secured by cryptography and the blockchain’s immutable nature. This makes them resistant to fraud and hacking. Traditional systems rely on centralized security measures, which can be vulnerable to attacks. However, users are responsible for the security of their wallets.

- Privacy: Crypto transactions can offer varying degrees of privacy. Bitcoin, for example, is pseudonymous, meaning transactions are tied to public addresses rather than personal identities. Some cryptocurrencies offer enhanced privacy features. Traditional systems often require users to provide personal information, increasing privacy risks.

- Borderless Transactions: Crypto payments can be sent and received globally without the need for intermediaries or currency conversions. This is a significant advantage for international trade and remittances. Traditional systems often involve high fees and delays for cross-border transactions.

A Brief History of Crypto Payments

The history of crypto payments is relatively short but marked by significant milestones that have shaped the financial landscape. These events have led to the development and adoption of crypto payment systems.

- 2008: Bitcoin Whitepaper: Satoshi Nakamoto published the Bitcoin whitepaper, introducing the concept of a decentralized digital currency. This marked the genesis of crypto payments and laid the foundation for the blockchain technology that underpins them. The whitepaper Artikeld a peer-to-peer electronic cash system.

- 2009: Bitcoin Launch: The Bitcoin network went live, and the first Bitcoin transactions were recorded. This event marked the birth of the first functional cryptocurrency and the beginning of the crypto payment revolution.

- Early 2010s: Bitcoin Adoption and Early Use Cases: Bitcoin began to gain traction, with early adopters using it for online purchases and remittances. The Silk Road marketplace, though controversial, demonstrated the potential of Bitcoin for facilitating anonymous transactions.

- 2013-2017: Altcoin Boom and ICO Era: The rise of alternative cryptocurrencies (altcoins) like Ethereum, Litecoin, and Ripple (XRP) expanded the crypto ecosystem. The Initial Coin Offering (ICO) boom saw numerous projects raising funds through the sale of crypto tokens, further driving interest and investment in crypto payments.

- 2017-2020: Institutional Interest and Regulatory Scrutiny: Institutional investors began to show interest in cryptocurrencies, leading to increased investment and market capitalization. Regulatory bodies worldwide started to grapple with how to regulate crypto assets and payment systems, leading to both challenges and opportunities for the industry.

- 2020-Present: Growing Adoption and Maturation: Crypto payments have seen increasing adoption by merchants and consumers. Companies like Tesla and MicroStrategy invested in Bitcoin, demonstrating the potential for mainstream adoption. Payment processors such as PayPal and Square (now Block) integrated crypto payment options. The maturation of the market has also led to the development of stablecoins, which are cryptocurrencies pegged to the value of fiat currencies, and have facilitated the development of decentralized finance (DeFi).

Benefits for Merchants and Customers

Crypto payment systems offer several benefits for both merchants and customers, making them an attractive alternative to traditional payment methods.

- For Merchants:

- Lower Transaction Fees: Crypto payments often have lower transaction fees compared to credit card processing fees, which can save merchants money.

- Faster Settlement Times: Transactions can settle much faster than traditional methods, improving cash flow.

- Global Reach: Crypto payments enable merchants to accept payments from customers worldwide without the need for currency conversions or international banking fees.

- Reduced Risk of Fraud: Blockchain technology makes crypto transactions more secure and less susceptible to fraud compared to traditional payment methods.

- Increased Security: Crypto payments offer enhanced security features, reducing the risk of chargebacks and fraudulent transactions.

- Access to New Customer Base: Accepting crypto payments can attract a new customer base, including crypto enthusiasts and investors.

- For Customers:

- Lower Transaction Fees: Customers can often avoid high transaction fees associated with traditional payment methods, especially for international transfers.

- Increased Privacy: Crypto transactions can offer greater privacy than traditional methods, as they are not tied to personal information.

- Faster Transactions: Crypto transactions can be faster, especially for international payments.

- Security: Crypto transactions are secured by cryptography, making them resistant to fraud and hacking.

- Global Access: Customers can make payments to anyone, anywhere in the world, without the need for intermediaries or currency conversions.

- Potential for Rewards: Some crypto payment systems offer rewards programs, such as cashback or discounts, for using their services.

Cryptocurrencies and Blockchain Fundamentals

Understanding the underlying principles of cryptocurrencies and blockchain technology is crucial for developing a crypto payment system. This section will delve into the different types of cryptocurrencies suitable for payments, the fundamental characteristics of a blockchain, and the role of smart contracts in automating payment processes. This knowledge forms the bedrock for building secure, efficient, and reliable crypto payment solutions.

Cryptocurrencies Suitable for Payments

Various cryptocurrencies are designed for use in payment systems, each with its own strengths and weaknesses. The choice of cryptocurrency often depends on the specific requirements of the payment system, such as transaction speed, fees, and stability.

- Bitcoin (BTC): Bitcoin, the first and most well-known cryptocurrency, offers a decentralized and secure payment option. Its widespread adoption makes it a readily accepted form of payment in many places. However, Bitcoin’s transaction speed can be slower compared to some other cryptocurrencies, and transaction fees can fluctuate depending on network congestion.

- Ethereum (ETH): Ethereum’s versatility, particularly its support for smart contracts, makes it suitable for complex payment systems. While Ethereum transactions can be faster than Bitcoin’s, the network can experience high gas fees during periods of high demand. The Ethereum network is undergoing significant upgrades, such as the move to Proof-of-Stake, which aims to improve scalability and reduce energy consumption.

- Stablecoins (e.g., USDT, USDC, DAI): Stablecoins are cryptocurrencies pegged to a stable asset, such as the U.S. dollar. This pegging helps to mitigate price volatility, making stablecoins suitable for everyday transactions and international payments. The stability of stablecoins can be a significant advantage in environments where price fluctuations are undesirable. However, it’s essential to consider the collateralization mechanisms and the regulatory status of the specific stablecoin.

- Litecoin (LTC): Litecoin was created as an alternative to Bitcoin, with faster transaction confirmation times. It often boasts lower transaction fees compared to Bitcoin, making it an attractive option for smaller payments. Litecoin has a larger maximum supply than Bitcoin, which contributes to its lower per-unit price.

- Ripple (XRP): Ripple, or XRP, is designed to facilitate fast and inexpensive international transactions. It is primarily used by financial institutions and payment processors. Ripple’s consensus mechanism differs from Bitcoin’s proof-of-work, enabling faster transaction speeds and lower fees. However, XRP is a centralized system that may cause concerns for some users.

Essential Characteristics of a Blockchain

Blockchain technology underpins all cryptocurrencies and offers unique features that make crypto payment systems secure and transparent. Understanding these core characteristics is fundamental.

- Decentralization: Blockchain networks are decentralized, meaning they are not controlled by a single entity. Instead, the network is distributed across multiple nodes (computers). This decentralization eliminates single points of failure and reduces the risk of censorship or manipulation.

- Immutability: Once a transaction is recorded on a blockchain, it cannot be altered or deleted. This immutability is achieved through cryptographic hashing and consensus mechanisms. Each block in the chain contains a hash of the previous block, creating a chain that is tamper-proof.

- Transparency: Transactions on a blockchain are typically transparent, meaning that anyone can view the transaction history. While user identities may be pseudonymous, the transaction details are publicly available. This transparency promotes trust and accountability within the system. However, privacy-focused blockchains are designed to provide a higher degree of anonymity.

The Role of Smart Contracts in Automating Payment Processes

Smart contracts are self-executing contracts written in code and stored on a blockchain. They automate various aspects of payment processing, offering significant benefits.

- Automated Payments: Smart contracts can automate payments based on predefined conditions. For example, a smart contract could release funds when a shipment is confirmed, or when a service is delivered. This automation reduces the need for intermediaries and speeds up payment processing.

- Escrow Services: Smart contracts can act as escrow agents, holding funds until certain conditions are met. This ensures that both parties fulfill their obligations before funds are released. This mechanism is useful in e-commerce, freelance platforms, and other situations where trust is crucial.

- Reduced Counterparty Risk: Smart contracts reduce counterparty risk by automating the execution of agreements. Because the contract’s logic is enforced by the blockchain, both parties can be confident that the terms will be followed.

- Increased Efficiency: Smart contracts streamline payment processes, reducing the need for manual intervention and paperwork. This leads to faster transaction times and lower operational costs.

Choosing a Crypto Payment Gateway

Selecting the right crypto payment gateway is crucial for businesses looking to accept cryptocurrencies. The choice impacts transaction processing, security, fees, and overall user experience. Careful consideration of available options ensures a smooth and secure integration.

Comparison of Popular Crypto Payment Gateways

Numerous crypto payment gateways exist, each with its strengths and weaknesses. The following table compares several popular options based on key features.

| Payment Gateway | Features | Fees | Supported Cryptocurrencies | Security Measures |

|---|---|---|---|---|

| Coinbase Commerce | Easy integration, hosted checkout, customizable buttons, open-source libraries, e-commerce platform plugins. | 1% transaction fee. | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), and more. | Two-factor authentication (2FA), PCI DSS compliance, regular security audits. |

| BitPay | Invoice creation, settlement in fiat currency, payment button integration, open-source libraries, fraud protection. | 1% transaction fee, with options for discounted fees for high-volume merchants. | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), XRP, and more. | Fraud detection, AML compliance, multi-signature support for advanced security. |

| NOWPayments | Supports 100+ cryptocurrencies, easy API integration, automatic coin conversion, customizable widgets, mass payouts. | 0.5% transaction fee. | Wide range of cryptocurrencies, including major and altcoins. | SSL encryption, IP whitelisting, KYC/AML compliance. |

| GoCoin | Supports multiple currencies, merchant tools, payment processing API, e-commerce platform integrations, fraud prevention. | 1% transaction fee. | Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), and more. | Advanced fraud detection, risk management tools, and security audits. |

Evaluating Payment Gateway Providers

Evaluating payment gateway providers requires a thorough assessment of various factors to ensure a suitable fit for business needs. This includes ease of integration and the quality of customer support.

- Ease of Integration: Consider the integration process with existing e-commerce platforms or custom websites. Look for clear documentation, readily available APIs, and plugins for popular platforms like WooCommerce, Shopify, and Magento. A straightforward integration process minimizes development time and costs. For example, Coinbase Commerce offers plugins for several popular e-commerce platforms, simplifying integration.

- Customer Support: Assess the availability and responsiveness of customer support. Check for various support channels, such as email, phone, and live chat. A responsive and helpful support team can quickly resolve issues and minimize downtime. Test the support responsiveness by contacting the provider with a pre-sales question.

- Transaction Fees: Analyze the fee structure, including transaction fees, setup fees, and any hidden charges. Compare fees across different providers to find the most cost-effective option for the business’s transaction volume. Higher transaction volumes might qualify for discounted rates.

- Supported Cryptocurrencies: Verify that the gateway supports the cryptocurrencies customers want to use. Ensure the gateway lists the cryptocurrencies that align with the target audience and business strategy.

- Settlement Options: Evaluate the settlement options available. Determine whether the gateway allows settlements in fiat currency, cryptocurrency, or both. Consider the frequency of settlements and associated fees.

- Reporting and Analytics: Assess the reporting and analytics capabilities. The gateway should provide detailed transaction reports, allowing businesses to track payments, identify trends, and manage finances effectively.

Security Considerations When Selecting a Payment Gateway

Security is paramount when selecting a crypto payment gateway. Several key aspects need careful consideration to protect funds and user data.

- Compliance with Regulations: Ensure the payment gateway complies with relevant financial regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Compliance reduces legal risks and ensures the gateway operates within established frameworks.

- Fraud Prevention: The gateway should have robust fraud prevention measures, such as address verification, transaction monitoring, and risk scoring. These measures help detect and prevent fraudulent transactions.

- Security Audits: Look for gateways that undergo regular security audits by independent third parties. These audits assess the gateway’s security practices and identify vulnerabilities.

- Data Encryption: The gateway should use strong encryption protocols, such as SSL/TLS, to protect sensitive data during transmission. This includes payment information and user credentials.

- Two-Factor Authentication (2FA): The gateway should support two-factor authentication to enhance account security. 2FA adds an extra layer of security by requiring a second verification method, such as a code from a mobile app, in addition to the password.

- Reputation and Reviews: Research the payment gateway’s reputation and read reviews from other users. This provides insights into the gateway’s reliability, security, and customer service. Look for gateways with a proven track record and positive feedback.

Setting Up a Crypto Payment System

Integrating a crypto payment system into your e-commerce platform requires careful planning and execution. This section will guide you through the technical aspects, focusing on practical implementation and essential considerations for secure and efficient crypto payment processing.

Integrating a Crypto Payment Gateway into an E-commerce Website

Integrating a crypto payment gateway involves several steps, varying slightly depending on the e-commerce platform used. This guide focuses on the process using a popular platform like WordPress with WooCommerce, providing a general overview applicable to other platforms such as Shopify, with necessary adjustments.

- Choosing and Setting Up a Payment Gateway Account: Select a crypto payment gateway based on your requirements (e.g., Coinbase Commerce, BitPay, NOWPayments). Sign up for an account on the chosen gateway’s website. This typically involves providing business details and completing verification procedures.

- Installing the Payment Gateway Plugin: For WordPress/WooCommerce, install the plugin provided by the chosen payment gateway. This plugin acts as the intermediary between your website and the payment gateway. You can find the plugin in the WordPress plugin repository or on the payment gateway’s website.

- Configuring the Plugin: After installation, configure the plugin within your WooCommerce settings. This usually involves:

- Entering API keys provided by the payment gateway.

- Specifying the cryptocurrencies you wish to accept.

- Setting up payment confirmation settings (e.g., number of confirmations required).

- Configuring transaction fees and currency conversions, if applicable.

- Testing the Integration: Conduct thorough testing to ensure the payment gateway functions correctly. Place test orders and verify that payments are processed, confirmed, and reflected in your gateway account. Confirm that the order status changes accordingly in your WooCommerce dashboard.

- Customization and Branding: Customize the payment process to align with your brand. This may involve modifying the payment page layout, adding your logo, and providing clear instructions for customers.

- Security and Compliance: Ensure the security of your website and payment integration. Implement HTTPS encryption, regularly update your website software and plugins, and comply with relevant data privacy regulations.

Generating and Managing Cryptocurrency Wallets

Managing cryptocurrency wallets is crucial for receiving and handling crypto payments. The process involves creating and securing wallets, understanding their functionalities, and implementing best practices for security.

- Choosing a Wallet Type: Select a wallet type suitable for your needs. Options include:

- Web Wallets: Convenient but potentially less secure. These wallets are accessed through a web browser.

- Mobile Wallets: Accessible on smartphones, offering a balance between convenience and security.

- Desktop Wallets: Installed on a computer, providing a higher level of security than web wallets.

- Hardware Wallets: The most secure option, storing private keys offline.

- Generating Wallet Addresses: Each cryptocurrency requires a unique wallet address. Within your chosen wallet, generate addresses for each cryptocurrency you intend to accept. These addresses are public and shared with customers for payment.

- Securing Private Keys: Private keys are the most important aspect of your wallet security. Store them securely, offline if possible. Never share your private keys with anyone. Use a hardware wallet for storing large amounts of cryptocurrency.

- Monitoring Transactions: Regularly monitor your wallet for incoming transactions. Use a blockchain explorer to track transaction confirmations and ensure payments are successful.

- Implementing Security Measures:

- Enable two-factor authentication (2FA) on your wallet.

- Use strong passwords and update them regularly.

- Be cautious of phishing attempts and malicious websites.

- Regularly back up your wallet.

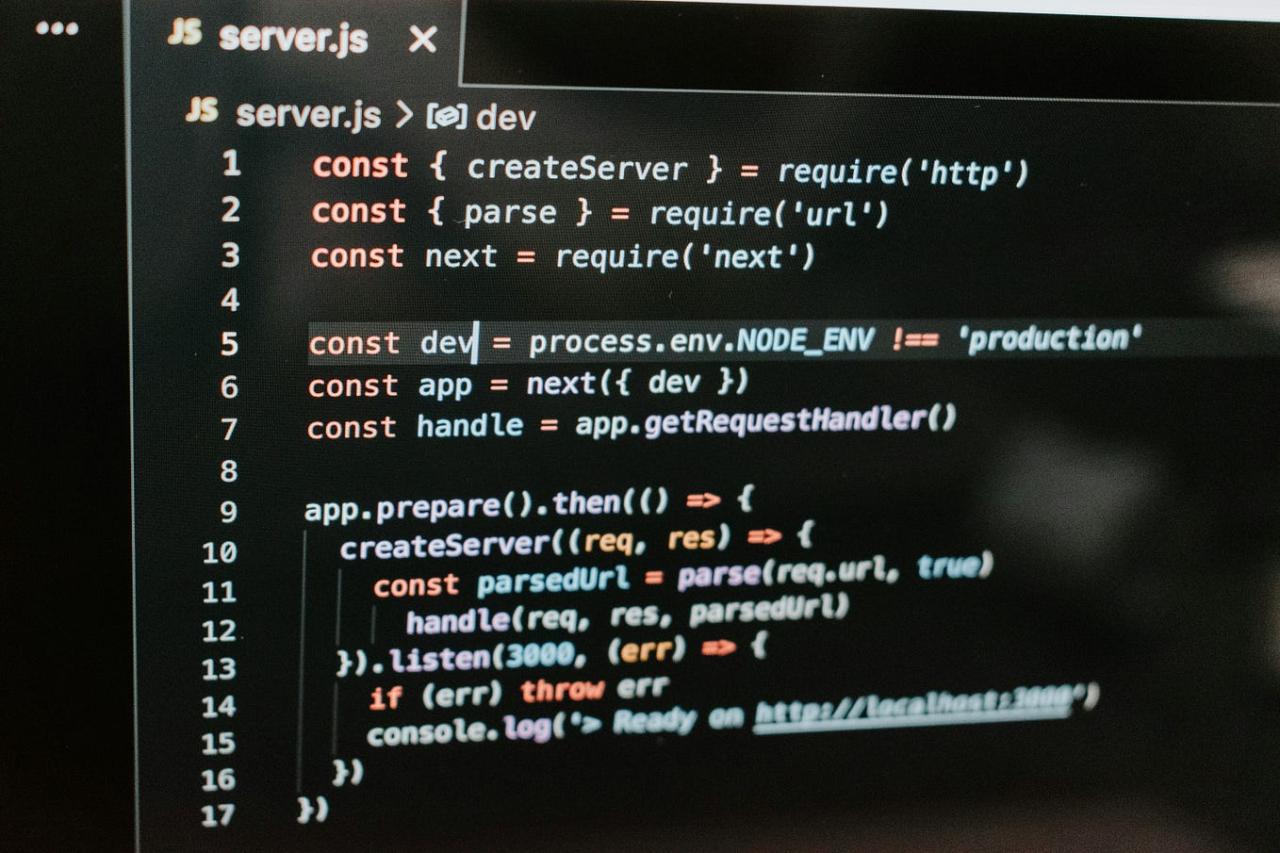

Programming Languages and Libraries for Crypto Payment System Development

Several programming languages and libraries are commonly used in the development of crypto payment systems. The choice of tools depends on the specific requirements of the project, including the platform, desired features, and security considerations.

- Programming Languages:

- JavaScript: Widely used for front-end and back-end development, especially with Node.js for server-side applications.

- Python: Popular for its versatility, with libraries for blockchain interaction and payment processing.

- PHP: Commonly used for e-commerce platforms like WordPress, offering compatibility with various payment gateways.

- Java: Suitable for enterprise-level applications and robust crypto payment system implementations.

- Libraries and Frameworks:

- Web3.js: A JavaScript library for interacting with Ethereum-based blockchains.

- Ethers.js: Another JavaScript library for interacting with Ethereum, offering similar functionalities to Web3.js.

- BitcoinJ: A Java library for working with Bitcoin and its blockchain.

- Cryptocurrency Libraries for Python (e.g., PyCoin, Bitcoinlib): Offer functionalities for generating wallets, signing transactions, and interacting with various cryptocurrencies.

- Payment Gateway SDKs: Most payment gateways provide Software Development Kits (SDKs) or APIs for integration with different programming languages.

- Databases:

- MySQL, PostgreSQL: Relational databases for storing transaction data, user information, and other relevant data.

- NoSQL Databases (e.g., MongoDB): Useful for storing unstructured data and handling large volumes of transactions.

Security Best Practices for Crypto Payments

Implementing robust security measures is paramount when integrating crypto payments. Protecting digital assets and user data requires a multi-faceted approach, encompassing secure key management, the prevention of fraudulent activities, and adherence to regulatory compliance. Failure to prioritize security can result in significant financial losses, reputational damage, and legal repercussions.

Securing Private Keys and Preventing Unauthorized Access

Securing private keys is the cornerstone of any secure crypto payment system. These keys are the cryptographic secrets that grant access to funds. Compromising them leads to immediate loss of assets. Therefore, rigorous security protocols are essential.

- Hardware Security Modules (HSMs): HSMs are physical devices that store and manage cryptographic keys in a secure, tamper-resistant environment. They provide a high level of security and are often used by businesses handling large volumes of cryptocurrency. HSMs generate, store, and protect private keys, performing cryptographic operations without exposing the keys to external threats. They are particularly effective against online attacks, ensuring that private keys never leave the secure hardware.

- Cold Storage: This involves storing private keys offline, isolated from the internet. This method, often utilizing hardware wallets (physical devices designed for key storage) or paper wallets (printed keys), significantly reduces the risk of online attacks. When a transaction is required, the keys are temporarily brought online to sign the transaction and then immediately returned to cold storage.

Example: A hardware wallet like a Ledger or Trezor securely stores private keys. When a user wants to send cryptocurrency, they connect the wallet to their computer, sign the transaction, and then disconnect it, returning the keys to offline storage.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security by requiring users to provide multiple forms of verification, such as a password and a code from an authenticator app or a biometric scan. This makes it significantly harder for unauthorized individuals to access accounts, even if they have obtained the password.

- Key Management Best Practices:

- Regular Backups: Regularly back up private keys to prevent loss due to hardware failure or other unforeseen circumstances. Store backups in a secure, encrypted location.

- Key Rotation: Rotate keys periodically to minimize the impact of potential key compromise. This involves generating new keys and transferring funds to addresses controlled by the new keys.

- Access Control: Implement strict access control measures to limit access to private keys to authorized personnel only. Use role-based access control (RBAC) to define permissions and responsibilities.

Preventing Double-Spending Attacks and Other Security Vulnerabilities

Double-spending attacks and other vulnerabilities can undermine the integrity of a crypto payment system. Proactive measures are crucial to mitigate these risks.

- Confirmation Times: Require a sufficient number of network confirmations before considering a transaction final. The number of confirmations needed varies depending on the cryptocurrency and the transaction amount. For instance, Bitcoin often requires six confirmations to be considered secure.

Bitcoin’s consensus mechanism makes double-spending extremely difficult. A transaction is considered confirmed when it is included in a block that has been added to the blockchain and validated by miners. The more blocks added after the transaction, the more confirmations it receives, increasing the security.

- Address Reuse Prevention: Avoid reusing addresses to enhance privacy and reduce the risk of linking transactions. Generate a new address for each transaction.

- Transaction Monitoring: Implement transaction monitoring systems to detect suspicious activity, such as unusually large transactions, transactions from known fraudulent addresses, or attempts to double-spend. These systems can alert security teams to potential threats in real-time.

- Smart Contract Audits: If using smart contracts, have them audited by reputable security firms. Audits identify vulnerabilities in the code that could be exploited by attackers.

Example: Companies like CertiK and Trail of Bits specialize in auditing smart contracts, providing detailed reports on potential security flaws and recommending remediation steps.

- Regular Security Audits: Conduct regular security audits of the entire payment system, including the code, infrastructure, and processes. These audits should be performed by independent security experts.

Best Practices for KYC and AML Compliance

Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is crucial for the legitimacy and long-term viability of any crypto payment system. These practices help prevent financial crimes and protect against regulatory penalties.

- KYC Procedures: Implement KYC procedures to verify the identity of users. This typically involves collecting information such as:

- Full Name

- Date of Birth

- Address

- Government-issued identification (e.g., passport, driver’s license)

Verify the provided information against trusted databases and sanction lists.

- AML Procedures: Implement AML procedures to monitor transactions and detect suspicious activity. This includes:

- Transaction Monitoring: Regularly monitor transaction activity for unusual patterns, such as large or frequent transactions, transactions to or from high-risk jurisdictions, and transactions involving known illicit addresses.

- Transaction Limits: Set transaction limits to mitigate the risk of money laundering.

- Suspicious Activity Reporting (SAR): Establish a process for reporting suspicious activity to the appropriate regulatory authorities.

- Data Privacy and Security: Ensure that all user data is handled securely and in compliance with data privacy regulations, such as GDPR and CCPA. Implement strong encryption and access controls to protect sensitive information.

- Regulatory Compliance: Stay up-to-date with all relevant KYC/AML regulations in the jurisdictions where the payment system operates. Engage with legal and compliance experts to ensure adherence to all applicable laws and regulations.

Example: The Financial Crimes Enforcement Network (FinCEN) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom are examples of regulatory bodies that oversee AML compliance. Crypto payment systems must register with and comply with the regulations set by these bodies.

Transaction Processing and Confirmation

Understanding how crypto transactions are processed and confirmed is crucial for building a reliable crypto payment system. This process ensures that payments are securely recorded on the blockchain and are irreversible, providing the foundation for trust in the system. Proper handling of confirmations directly impacts the user experience and the security of the payment process.

Confirming Crypto Transactions on a Blockchain

The confirmation process verifies the validity of a crypto transaction and adds it to the blockchain. This process varies slightly depending on the specific cryptocurrency and its underlying consensus mechanism, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS).The general steps involved in confirming a crypto transaction are:

- Transaction Initiation: A user initiates a transaction by sending cryptocurrency from their wallet to another address. This transaction includes the recipient’s address, the amount of cryptocurrency, and often a transaction fee.

- Transaction Propagation: The transaction is broadcast to the network of nodes. These nodes are computers that maintain a copy of the blockchain and validate transactions.

- Transaction Validation: Nodes validate the transaction by checking its validity against several criteria. This includes verifying that the sender has sufficient funds, that the transaction is properly formatted, and that it adheres to the rules of the specific cryptocurrency protocol.

- Block Creation (Mining or Staking):

- PoW (Mining): In PoW systems like Bitcoin, miners compete to solve a complex cryptographic puzzle. The first miner to solve the puzzle gets to add a new block containing a batch of transactions to the blockchain. This process requires significant computational power.

- PoS (Staking): In PoS systems, validators are chosen based on the amount of cryptocurrency they hold (stake). Validators propose and validate new blocks. This method is generally more energy-efficient than PoW.

- Block Propagation and Validation: The new block is propagated to other nodes on the network. These nodes validate the block to ensure that it adheres to the consensus rules of the blockchain.

- Confirmation: Once a block containing the transaction is added to the blockchain and validated by a sufficient number of nodes, the transaction is considered confirmed. Subsequent blocks added to the blockchain further confirm the transaction. Each additional block increases the confidence level that the transaction is irreversible.

Factors Influencing Transaction Confirmation Times

Several factors can affect how quickly a crypto transaction is confirmed. Understanding these factors allows you to optimize your system for a better user experience.The primary factors that influence transaction confirmation times include:

- Network Congestion: High network traffic can lead to longer confirmation times. When many transactions are being processed simultaneously, the blockchain can become congested, increasing the time it takes for transactions to be included in a block.

- Transaction Fees: Miners or validators prioritize transactions with higher fees. Setting a higher transaction fee can incentivize miners to include your transaction in a block more quickly. The fee acts as a reward for the miners, encouraging them to process the transaction.

- Blockchain’s Block Time: Each cryptocurrency has a defined block time, which is the average time it takes to mine or validate a new block. For example, Bitcoin has a block time of approximately 10 minutes, while other cryptocurrencies may have faster block times.

- Number of Confirmations Required: The number of confirmations considered sufficient for a transaction to be considered secure varies. Typically, more confirmations provide a higher level of security. The required number of confirmations depends on the specific cryptocurrency and the risk tolerance of the application.

For instance, in Bitcoin, waiting for six confirmations is generally considered secure, representing about an hour of processing time. However, for smaller transactions, fewer confirmations might be acceptable. In contrast, cryptocurrencies with faster block times may require fewer confirmations to achieve a similar level of security in a shorter timeframe.

Handling Payment Confirmations and Order Fulfillment

Implementing payment confirmations and order fulfillment involves integrating the crypto payment system with your order processing workflow. This typically includes monitoring the blockchain for transaction confirmations and then triggering the appropriate actions.Here’s an example of how to handle payment confirmations and order fulfillment:

- Receive Payment Notification: The payment gateway or your system receives a notification when a transaction is initiated. This could be through webhooks or API calls.

- Check Transaction Status: Regularly check the status of the transaction on the blockchain. This involves querying the blockchain for the transaction details, including the number of confirmations.

- Define Confirmation Threshold: Determine the minimum number of confirmations required before fulfilling the order. This depends on the cryptocurrency, transaction value, and your risk tolerance. For example, you might require three confirmations for smaller transactions and six or more for larger ones.

- Order Fulfillment Trigger: Once the transaction has reached the defined confirmation threshold, trigger the order fulfillment process. This might include updating the order status in your database, sending a confirmation email to the customer, and initiating the delivery of goods or services.

- Error Handling: Implement robust error handling to manage potential issues. This includes handling failed transactions, insufficient confirmations, and network errors. You should provide a mechanism for customers to contact support if their order is not processed correctly.

Here’s a simplified code example (using a hypothetical library):“`python# Hypothetical code, not runnable without a specific libraryfrom crypto_payment_library import get_transaction_detailsdef process_payment(transaction_id, confirmations_required=3): transaction_details = get_transaction_details(transaction_id) if transaction_details is None: print(“Transaction not found.”) return False if transaction_details[‘confirmations’] >= confirmations_required: print(“Payment confirmed. Proceeding with order fulfillment.”) # Implement order fulfillment logic here return True else: print(f”Payment pending.

Current confirmations: transaction_details[‘confirmations’]/confirmations_required”) return False“`In this example:

The function `get_transaction_details` is used to retrieve transaction details from the blockchain. The code checks if the transaction has reached the required number of confirmations and then triggers the order fulfillment process.

This approach provides a basic framework. In a real-world application, you would integrate this logic with a payment gateway and your order management system, including features for retrying failed confirmations and handling disputes.

Managing Crypto Payments: Accounting and Reporting

Effectively managing crypto payments involves more than just accepting them; it necessitates robust accounting practices and accurate reporting to ensure financial transparency, regulatory compliance, and informed decision-making. This section Artikels methods for converting crypto to fiat, designing transaction tracking systems, and navigating the tax implications of accepting crypto payments.

Converting Crypto Payments into Fiat Currency

The conversion of cryptocurrency payments into fiat currency is a crucial step for businesses to manage their finances and meet operational expenses. Several methods are available, each with its own advantages and considerations.

- Using Crypto Exchanges: Cryptocurrency exchanges offer a straightforward way to convert crypto into fiat. This involves transferring the received cryptocurrency to the exchange, selling it for fiat currency (e.g., USD, EUR), and then withdrawing the fiat funds to a bank account. Exchanges typically charge fees for transactions and withdrawals. The conversion rate is determined by market forces and the exchange’s trading platform.

It’s essential to research and select reputable exchanges with strong security measures and positive user reviews.

- Utilizing Payment Gateways with Fiat Conversion: Some crypto payment gateways offer built-in fiat conversion services. These gateways automatically convert incoming crypto payments into fiat and deposit the funds directly into the business’s bank account. This simplifies the process and reduces the need for manual intervention. The gateway typically handles the conversion and associated fees, which are often transparently disclosed.

- Over-the-Counter (OTC) Trading: For large transactions, businesses may consider OTC trading desks. OTC desks provide personalized services and can offer better exchange rates than public exchanges. They cater to institutional investors and high-net-worth individuals and typically require higher minimum transaction amounts. OTC trading can provide greater privacy and potentially reduce the impact of large trades on market prices.

- Peer-to-Peer (P2P) Platforms: P2P platforms connect buyers and sellers directly, allowing for the exchange of crypto for fiat. These platforms often facilitate the transaction through escrow services to ensure security. While P2P platforms can offer competitive rates, they require careful due diligence to avoid fraud and scams.

Designing a System for Tracking Crypto Transactions and Generating Financial Reports

Tracking crypto transactions and generating financial reports requires a well-structured system to ensure accuracy, compliance, and financial control.

- Choosing Accounting Software: Select accounting software that supports cryptocurrency transactions. Some popular options include:

- Specialized Crypto Accounting Software: Platforms like Accointing, Koinly, and CoinTracker are designed specifically for crypto accounting, offering features like automatic transaction importing, tax reporting, and portfolio tracking.

- Traditional Accounting Software with Crypto Integration: Software like QuickBooks, Xero, and FreshBooks can be integrated with crypto exchanges and wallets through APIs or manual data entry. Consider add-ons or plugins that enhance crypto functionality.

- Transaction Data Import and Categorization: Import transaction data from crypto wallets, exchanges, and payment gateways into the chosen accounting software. Categorize each transaction accurately, including:

- Date and time of the transaction.

- Cryptocurrency involved.

- Amount of cryptocurrency.

- Fiat equivalent at the time of the transaction (using a reliable exchange rate source).

- Transaction fees.

- Purpose of the transaction (e.g., sale of goods, service payment).

- Counterparty (e.g., customer, vendor).

- Generating Financial Reports: Generate financial reports, including:

- Income Statement: Reflecting revenue from crypto sales, expenses, and net profit or loss.

- Balance Sheet: Showing crypto holdings as assets and liabilities.

- Cash Flow Statement: Tracking the movement of crypto and fiat currencies.

- Capital Gains/Losses Report: Calculating capital gains or losses from the sale or exchange of cryptocurrencies.

- Regular Reconciliation: Regularly reconcile crypto holdings and transactions with the data from exchanges and wallets to ensure accuracy and identify discrepancies.

- Data Security and Backup: Implement robust data security measures to protect sensitive financial information. Regularly back up accounting data to prevent data loss.

Tax Implications of Accepting Crypto Payments and Resources for Staying Compliant

Accepting cryptocurrency payments has significant tax implications that businesses must understand to remain compliant with tax regulations.

- Taxable Events: The receipt of cryptocurrency payments is generally considered a taxable event. The value of the cryptocurrency received is treated as income at the fair market value on the date of receipt.

For example, if a business receives 1 Bitcoin (BTC) as payment for a service when the market value of BTC is $30,000, the business must report $30,000 as income.

- Calculating Cost Basis: When converting crypto to fiat or using crypto to pay expenses, the cost basis of the cryptocurrency must be determined. The cost basis is the original purchase price of the cryptocurrency. Capital gains or losses are calculated based on the difference between the fair market value at the time of sale or exchange and the cost basis.

- Record Keeping: Maintain detailed records of all crypto transactions, including:

- Date and time of each transaction.

- Type of transaction (e.g., receipt, sale, exchange).

- Cryptocurrency and amount involved.

- Fair market value at the time of the transaction.

- Cost basis (if applicable).

- Purpose of the transaction.

- Tax Reporting: Report crypto transactions on relevant tax forms. The specific forms and reporting requirements vary depending on the jurisdiction. In the United States, for example, the IRS requires reporting on Schedule D (Form 1040) for capital gains and losses. Consult with a tax professional to ensure accurate reporting.

- Resources for Staying Compliant:

- Tax Professionals Specializing in Cryptocurrency: Seek advice from tax professionals who specialize in cryptocurrency taxation. They can provide guidance on complex tax rules and help businesses stay compliant.

- Tax Software and Services: Utilize tax software and services designed for crypto taxation. These tools can automate the calculation of capital gains and losses and generate necessary tax forms.

- Government Resources: Stay informed about the latest tax regulations and guidance from relevant government agencies (e.g., the IRS in the United States, HMRC in the United Kingdom).

Advanced Features and Customization

Beyond the core functionalities of accepting and processing crypto payments, advanced features and customization options allow businesses to tailor their crypto payment systems to specific needs, enhancing user experience and operational efficiency. This section explores these advanced capabilities, focusing on leveraging APIs, implementing recurring payments, and supporting multi-currency transactions.

Leveraging Payment APIs for Custom Solutions

Payment Application Programming Interfaces (APIs) are crucial for building custom payment solutions. They offer a flexible and powerful way to integrate crypto payments directly into a business’s existing systems, offering control over the payment process.

Payment APIs provide a standardized interface for interacting with crypto payment gateways, allowing developers to create tailored payment experiences that align with their specific business requirements.

This customization can range from integrating payments into existing e-commerce platforms to developing entirely new payment flows. The use of APIs empowers businesses to create unique user interfaces, automate payment processes, and implement advanced features.

Implementing Recurring Payments and Subscriptions

Recurring payments and subscription models are essential for many businesses. Implementing these features in a crypto payment system can significantly improve revenue streams and customer retention.Implementing recurring payments in a crypto payment system involves several steps. First, it is essential to choose a crypto payment gateway that supports recurring billing. Then, the business must integrate the gateway’s API into its system, enabling it to automatically charge customers at regular intervals.

Furthermore, the system should allow customers to manage their subscriptions, including the ability to cancel or modify their payment plans.

- Automated Billing: Set up automatic deductions for subscription fees, eliminating manual invoice generation.

- User Management: Enable users to manage their subscriptions, update payment details, and cancel at any time.

- Notifications: Implement automated email notifications to inform customers of upcoming payments, successful transactions, and potential issues.

- Security Measures: Use secure methods for storing and processing customer payment information, including encryption and tokenization.

Businesses using this method can enjoy the benefits of a consistent revenue stream and increased customer loyalty. An example of this is the platform, which offers crypto-based subscription services for content creators, allowing them to receive payments directly from their subscribers without intermediaries.

Incorporating Multi-Currency Support

Multi-currency support is essential for businesses operating globally, as it allows them to accept payments in various cryptocurrencies and potentially fiat currencies.To implement multi-currency support, the payment system must be able to handle different cryptocurrencies and convert them into a single currency for accounting purposes. This usually involves integrating with cryptocurrency exchanges or price feeds to determine the current exchange rates.

- Cryptocurrency Support: Ensure the system supports a wide range of cryptocurrencies, such as Bitcoin, Ethereum, and other popular altcoins.

- Exchange Rate Integration: Integrate with reliable cryptocurrency price feeds to get real-time exchange rates.

- Conversion and Settlement: Automate the conversion of received cryptocurrencies into the business’s preferred currency.

- Reporting: Provide detailed reports on transactions in different currencies, including exchange rates and fees.

For example, a global e-commerce platform might accept payments in Bitcoin, Ethereum, and Litecoin, automatically converting these into the business’s local currency for accounting. This allows the business to reach a broader customer base and avoid the limitations of accepting only one currency.

Legal and Regulatory Considerations

Navigating the legal and regulatory landscape is crucial for any business integrating crypto payment systems. Understanding the evolving rules across different jurisdictions, the associated risks, and how to stay informed is essential for compliance and operational stability. Failure to comply can lead to severe penalties, including fines and legal action, which can severely impact a business’s viability.

Key Regulations Surrounding Crypto Payments in Different Jurisdictions

The regulatory environment for crypto payments varies significantly from country to country. Businesses must understand the specific requirements of each jurisdiction where they operate or where their customers are located. This often involves registering with financial authorities, complying with anti-money laundering (AML) and know-your-customer (KYC) regulations, and potentially obtaining licenses to operate as a virtual asset service provider (VASP).

- United States: The regulatory landscape is complex, with different agencies like the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN) playing roles. FinCEN, for instance, requires VASPs to register and comply with AML regulations. State-level regulations also exist, with New York’s BitLicense being a prominent example. The SEC’s stance on whether certain cryptocurrencies are securities significantly impacts how they can be used and offered.

- European Union: The EU has implemented the Markets in Crypto-Assets (MiCA) regulation, which aims to create a comprehensive framework for crypto assets. MiCA addresses issues such as licensing requirements for crypto asset service providers, consumer protection, and market integrity. The regulation is designed to provide a more harmonized approach across member states, reducing regulatory fragmentation.

- United Kingdom: The Financial Conduct Authority (FCA) regulates crypto asset businesses. Businesses involved in crypto activities must register with the FCA and comply with AML regulations. The UK government is also exploring further regulations to govern the crypto sector.

- Switzerland: Switzerland has a relatively crypto-friendly regulatory environment. The Swiss Financial Market Supervisory Authority (FINMA) regulates crypto businesses, with a focus on AML and combating terrorist financing. FINMA has issued guidelines on how crypto businesses can comply with existing financial regulations.

- Other Jurisdictions: Other countries, such as Singapore, Japan, and Australia, have also developed their own regulatory frameworks. These frameworks often include licensing requirements, AML/KYC obligations, and guidelines on consumer protection. The specifics of these regulations vary significantly.

Risks Associated with Using Crypto Payment Systems

Adopting crypto payment systems introduces several risks that businesses must carefully manage. These risks can impact financial stability, legal compliance, and operational efficiency.

- Volatility: Cryptocurrency prices can fluctuate dramatically and rapidly. This volatility can lead to significant financial losses if businesses are not prepared to manage it. For example, a business that receives Bitcoin as payment might see the value of that Bitcoin decrease substantially before it can be converted into fiat currency. Hedging strategies, such as using stablecoins or immediately converting crypto to fiat, can mitigate this risk.

- Regulatory Uncertainty: The regulatory landscape for crypto is constantly evolving, and new regulations can be introduced with little notice. This uncertainty can make it difficult for businesses to comply with all applicable laws and regulations. Changes in regulations can also impact the viability of certain crypto payment systems.

- Security Risks: Crypto transactions are susceptible to hacking, theft, and fraud. Businesses must implement robust security measures to protect their crypto assets and prevent unauthorized access. These measures include using secure wallets, implementing multi-factor authentication, and regularly auditing their systems.

- Compliance Challenges: Complying with AML and KYC regulations can be complex and resource-intensive. Businesses must implement processes to verify the identities of their customers and monitor transactions for suspicious activity. Failure to comply with these regulations can result in significant penalties.

- Scalability Issues: Some cryptocurrencies have limitations in terms of transaction processing speed and capacity. This can lead to delays and increased transaction fees during periods of high demand. Businesses need to consider the scalability of the cryptocurrencies they choose to accept as payment.

Resources for Staying Informed About the Latest Legal Developments in the Crypto Payment Space

Staying up-to-date on legal and regulatory changes is critical for businesses operating in the crypto payment space. Numerous resources provide information and analysis on the latest developments.

- Industry Publications and News Websites: Publications such as CoinDesk, CoinTelegraph, and The Block provide regular updates on regulatory developments, market trends, and industry news. These sources offer insights into the latest regulatory actions and their potential impact.

- Government Websites and Regulatory Agencies: Websites of regulatory agencies, such as the SEC, CFTC, FCA, and FINMA, provide official announcements, guidance, and publications related to crypto regulations. Regularly checking these websites is essential for staying informed about the latest changes.

- Legal and Consulting Firms: Many law firms and consulting firms specialize in crypto regulation and provide legal advice and compliance services. These firms often publish articles, reports, and webinars on current legal issues and developments.

- Industry Associations: Organizations like the Blockchain Association and the Crypto Council for Innovation advocate for the crypto industry and provide resources on legal and regulatory matters. They often publish reports, conduct educational events, and engage with policymakers.

- Conferences and Events: Attending industry conferences and events is an excellent way to learn about the latest legal developments and network with experts in the field. These events often feature presentations and discussions on regulatory topics.

Future Trends in Crypto Payments

The crypto payment landscape is dynamic and rapidly evolving, driven by technological advancements and changing user behaviors. Understanding these future trends is crucial for businesses and individuals seeking to leverage the benefits of crypto payments. This section explores emerging technologies, potential applications, and the challenges and opportunities that lie ahead.

Emerging Technologies and Trends

Several key technologies and trends are poised to significantly impact the future of crypto payments. These advancements promise to enhance efficiency, security, and user experience.

- Decentralized Finance (DeFi): DeFi platforms are reshaping financial services by offering lending, borrowing, and trading without intermediaries. The integration of crypto payments with DeFi allows for seamless transactions, providing users with access to a wider range of financial products and services. For instance, users can deposit crypto into a DeFi protocol to earn interest and then use those funds to make purchases, creating a more integrated financial ecosystem.

- Web3 Integration: Web3, the next iteration of the internet, aims to be decentralized and user-centric. Crypto payments are a core component of Web3, enabling peer-to-peer transactions and empowering users with greater control over their data and finances. Websites and applications built on Web3 are increasingly integrating crypto payment options.

- Layer-2 Scaling Solutions: Blockchain scalability is a persistent challenge. Layer-2 solutions, such as the Lightning Network for Bitcoin, offer faster and cheaper transactions by processing them off the main blockchain. This significantly improves the usability of crypto payments for everyday transactions.

- Stablecoins: Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, mitigate the volatility associated with other cryptocurrencies. Their stability makes them attractive for everyday payments and business transactions, providing a more predictable value proposition.

- Cross-Chain Interoperability: The ability to seamlessly transfer value between different blockchains is essential for the future of crypto payments. Cross-chain bridges and protocols are being developed to facilitate interoperability, allowing users to transact across multiple blockchain networks.

Potential Future Applications in Various Industries

Crypto payments have the potential to revolutionize numerous industries. Their benefits, including reduced transaction costs, increased transparency, and enhanced security, make them attractive for a variety of applications.

- E-commerce: Online retailers are increasingly adopting crypto payments to cater to a global audience and reduce transaction fees. Crypto payments can also help businesses avoid chargebacks and fraud.

- Gaming: In-game purchases and rewards can be easily managed using crypto payments. The decentralized nature of crypto can also empower gamers with greater control over their digital assets.

- Supply Chain Management: Crypto payments can facilitate transparent and efficient tracking of goods throughout the supply chain. Blockchain technology provides an immutable record of transactions, enhancing accountability and reducing fraud.

- Remittances: Crypto payments offer a faster and cheaper alternative to traditional remittance services. Cross-border payments can be completed quickly and at a lower cost, benefiting both senders and recipients.

- Healthcare: Crypto payments can be used for medical billing, insurance claims, and research funding. Blockchain technology can also secure patient data and streamline healthcare administration.

- Real Estate: Crypto payments can simplify property transactions, reducing paperwork and speeding up the closing process. Tokenization of real estate assets can also make them more accessible to a wider range of investors.

- Content Creation: Creators can receive direct payments from their audiences using crypto, bypassing intermediaries and retaining more of their earnings. Platforms like YouTube and Twitch are exploring crypto integration to support content creators.

Challenges and Opportunities Facing the Future of Crypto Payment Systems

The future of crypto payments is not without its challenges, but these challenges also present significant opportunities for innovation and growth.

- Scalability: Addressing the scalability limitations of existing blockchains is crucial for supporting mass adoption of crypto payments. Layer-2 solutions and new blockchain architectures are actively being developed to improve transaction throughput.

- Volatility: The price volatility of cryptocurrencies can deter businesses and consumers. The wider adoption of stablecoins can help mitigate this issue and provide a more stable payment option.

- Regulatory Uncertainty: Clear and consistent regulations are needed to foster trust and encourage widespread adoption. Governments worldwide are working to establish regulatory frameworks for cryptocurrencies.

- Security: Protecting crypto assets from theft and fraud is a top priority. Implementing robust security measures, such as multi-factor authentication and cold storage, is essential.

- User Experience: Simplifying the user experience is key to attracting mainstream users. Improving wallet interfaces, providing educational resources, and streamlining the payment process can enhance user adoption.

- Interoperability: Creating a seamless experience across different blockchains is crucial for the future of crypto payments. Cross-chain solutions and standardized protocols will be necessary to achieve this.

- Education and Awareness: Educating the public about the benefits and risks of crypto payments is vital for driving adoption. Increased awareness can help overcome skepticism and encourage wider usage.

Final Wrap-Up

In conclusion, mastering the art of coding a crypto payment system opens doors to a world of opportunities. By understanding the underlying technologies, implementing secure practices, and staying informed about the evolving regulatory landscape, you can confidently navigate the crypto payment ecosystem. As the industry continues to evolve, embracing innovation and adaptability will be key to success. The insights provided here offer a solid foundation for building robust, secure, and future-proof crypto payment solutions.